Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Rate hikes, fuel spikes and EM sovereign HY

Historically, global food and fuel price squeezes have been bad news for high-yielding sovereigns, but we believe a number of factors could lead to a different outcome this time around.

Unless you’ve been hiding under a rock recently, you’re probably aware that global food and fuel prices are rising fast.

This dynamic has historically been challenging for emerging market (EM) sovereign high yield (HY), as lower levels of income and savings in EMs mean rising prices can more easily lead to social pressures.

Meanwhile, a slowdown in advanced economies will have ramifications for global growth and commodity prices, potentially crimping the export revenues of many EMs.

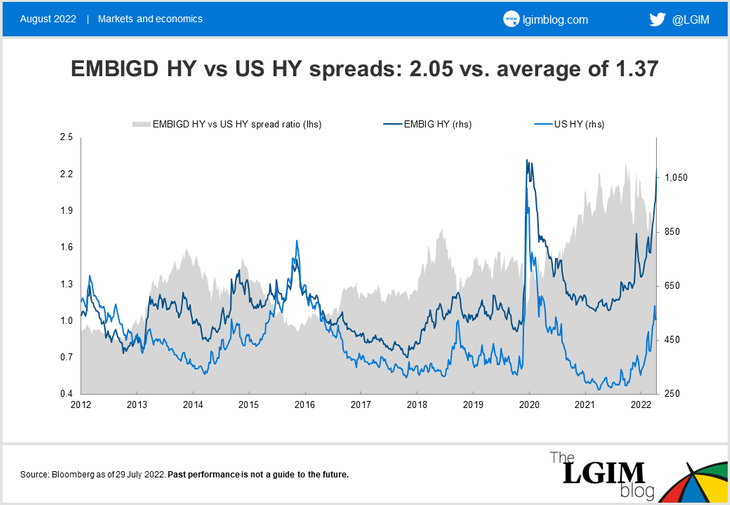

But we think there are good reasons to believe EM sovereign HY may in fact be more strongly positioned than the above would suggest – particularly in light of a year of very poor performance that has left spreads in the 97th percentile over 10 years.1 This widening has outpaced that seen in US HY, as shown in the chart below:

Pockets of value

We believe the tendency of the market to classify the entire EM sovereign HY asset class in one bucket means credit differentiation could potentially help unlock value in the space.

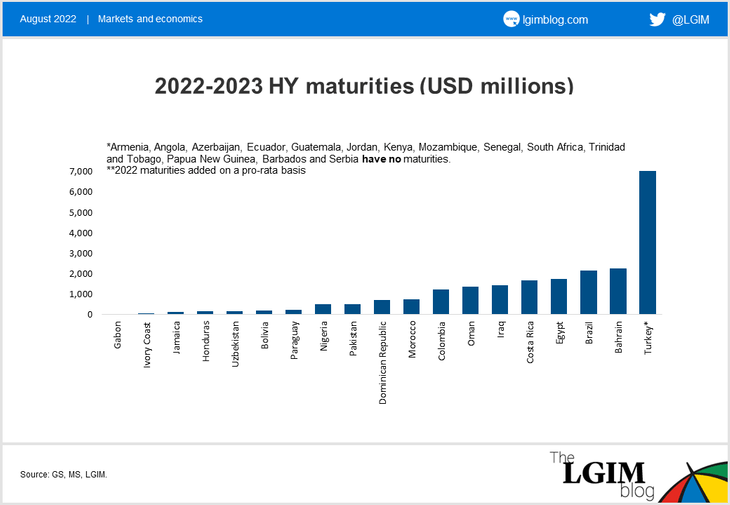

What supports this view? To begin with, external maturities in sovereign HY remain modest until 2024. In sovereign single Bs, maturities average less than $10 billion a year, falling to $3 billion this year and $7 billion next year, excluding Turkey.

This reflects the fact that many high-yielding countries did not start borrowing aggressively from global markets until 2014. The wall of maturities will not therefore hit until 2024, providing time, in our view, for markets to calm down.

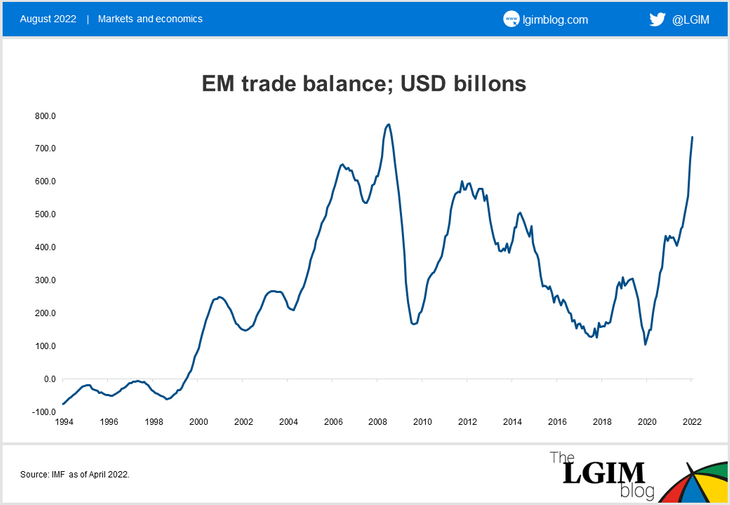

Meanwhile, higher commodity prices have been helping deliver unprecedented EM trade surpluses. This, together with strong support from multilateral agencies, means EM external liquidity is in better shape than it was during previous food and fuel price peaks.

Indeed, many HY sovereigns such as Gabon, Kenya and Senegal benefit from existing International Monetary Fund (IMF) programmes, whereas nations such as Egypt and Pakistan are in the middle of IMF discussions. Having an IMF programme in place means there is no external financing gap foreseen.

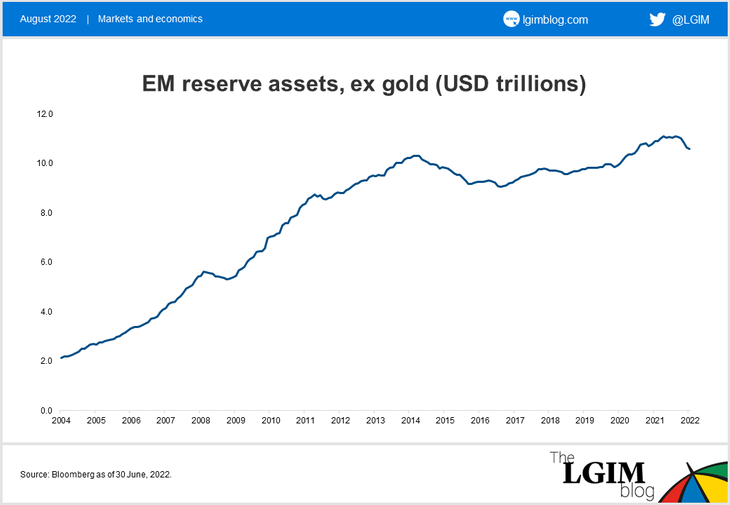

As a result of these trade balance and multilateral supports, EM foreign exchange reserves remain healthy, and higher than in previous food and fuel price peaks.

Also supporting the view that there is no broad-based weakness in sovereign HY countries, Azerbaijan, Vietnam, Paraguay, Kuwait, Angola, Brazil, Ivory Coast and Guatemala have all either been upgraded or had rating outlooks move in a positive direction in the past two months.

Growth and inflation worries

Where there is a concern, particularly in the lower-rated countries, is on the growth and inflation front. As noted above, lower levels of income and savings mean buffers are more limited, and the weak growth outlook for developed markets will weigh on commodity prices.

However, EMs are significantly ahead in the rate hike cycle, despite which they are still set to outpace advanced economies on the growth front, testifying to their resilience. Meanwhile, the most painful driver of inflation – commodity prices – has turned as markets shift their focus to growth dynamics in advanced economies. EMs also have higher GDP per capita than in previous food and fuel price peaks.

Credit selection is key

Given the above, in the context of still attractive valuations, we believe there could be opportunities in the EM sovereign HY space.

However, this will be dependent not only upon risk appetite holding, and both US rates and outflows from the asset class stabilising, but also on selecting the right credits.

1. Source: Bloomberg, as at 29 July 2022.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.