Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

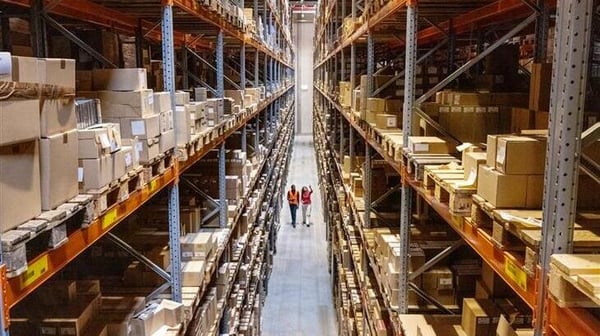

UK Industrial: Positioning for the next phase of growth

Read our latest report on the evolving Industrial Real Estate landscape

In recent times we’ve observed that the performance of broad real estate sectors seems to be converging. In this context, it may mean investors should exercise greater selectivity within an evolving industrial sector when seeking outperformance.

While industrial real estate’s relative performance prospects, in our view, are likely to remain strong in the long term, we believe the extent of outperformance seen over previous cycles is unlikely to be repeated.

Saying this, we believe the long-term drivers of industrial property demand remain both positive and broad-based, with the potential for future growth in the sector supported by two global megatrends – Digitalisation and Deglobalisation.

We believe care asset and segment selection within Industrials remains critical, with the age of properties and associated capex requirements being increasingly important.

You can read our full report on the UK Industrial Real Estate sector here.

Assumptions, opinions and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts will come to pass.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.