Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Investment-grade credit: not out of the woods yet

Several months have passed since the start of the pandemic and the investment-grade market has had time to adjust to the seismic deterioration in credit quality. After a wave of rating downgrades, including a record volume of fallen angels, the pace of rating actions has slowed. Credit market volatility has fallen and we expect a period of relative calm.

Central banks across the world stepped in to support investment-grade companies very early on, which in turn opened up primary markets and provided ample liquidity to even the more challenged credits. This has bought companies time to assess and try to repair the damage. For the most part, we think that management teams have done the right thing by slashing dividends, cutting costs and in some cases raising equity.

However, we are not yet out of the woods. We think that the downgrades aren’t over, even under a best case V-shaped recovery. And it’s very possible that the current period of stability could be relatively short lived. If we experience a widespread second wave of infections and lockdowns, or the elusive V-shaped recovery turns into a disappointing ‘U’ or ‘W’, we could see many more rating actions in late 2020 and early 2021. We think the market has largely priced in the initial repercussions of COVID-19, but at this point we believe that potential second and third-order impacts – including a potential prolonged economic downturn – are not reflected in spreads. We therefore think this period of likely stability could present a good opportunity to insulate portfolios against these risks.

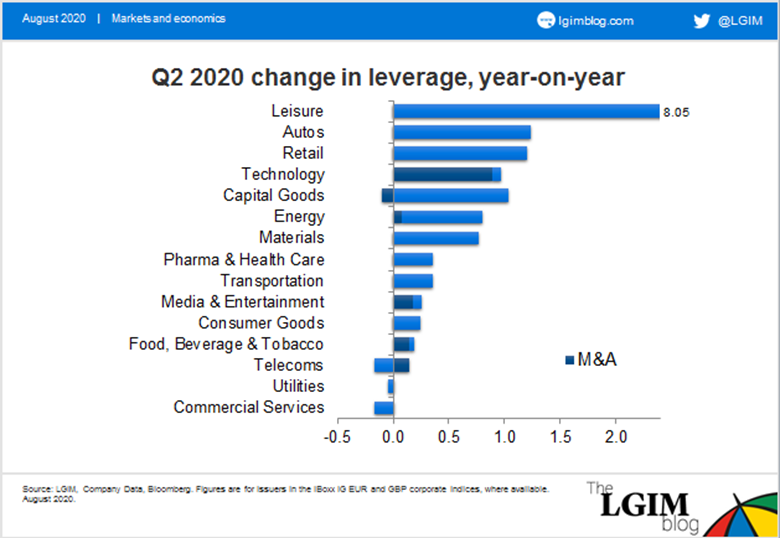

The challenge for credit markets, in our view, is that the subsequent rounds of downgrades will be quite different from the first. During the first phase of this crisis, the hardest-hit companies saw their revenues collapse as lockdowns across the world either eroded demand or shut down production. During the second-quarter earnings season, we have witnessed the damage that this has inflicted on balance sheets. It's not pretty so far, but it is also no surprise to the market. The most severely affected sectors are also those where the rating agencies and markets reacted quickly to this crisis, so ratings and spreads largely reflect these risks already.

The next stage of downgrades is likely to be slower and also to encompass a wider range of companies. Those hit hard by lockdown, but where a strong balance sheet has so far provided rating protection, will look vulnerable as cratering earnings erode the leverage denominator. If consumer demand and corporate investment fails to rebound, then a whole host of traditional cyclicals are also at risk.

Overall, although we expect the second half of 2020 to be much calmer than the first, these remain challenging market conditions for credit investors, especially now that spreads have recovered substantially from the extremes of March. The good news for investors is that this crisis and its implications are now more widely understood than they were a few months ago, which means that many of the landmines have already been exposed. Although we see pockets of mispriced risk, we still see potential value in investment-grade credit as an asset class, at least for now.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.