Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Global high yield: resilient fundamentals and strong demand for yield

Falling interest rate expectations and strong corporate fundamentals continue to underpin the market, even as risks persist.

This article is an extract from our Q1 2026 Active Fixed Income Outlook.

The past – what just happened?

Markets entered the fourth quarter of 2025 with a more cautious tone as prolonged uncertainty around the US government shutdown and limited economic data weighed on sentiment. Concerns over stretched valuations in AI-related sectors also contributed to volatility, prompting a modest widening in high-yield spreads since the end of September. Despite this, overall technicals remain supportive in our view, with steady demand for income and manageable new issuance.

Performance has been mixed across regions. Emerging markets and the US have led gains, supported by what we view to be resilient fundamentals and attractive yields, while Europe struggled in November amid weaker growth signals and political uncertainty. From a ratings perspective, BB credits outperformed as lower-rated cohorts lagged during periods of volatility.

The present – capturing income opportunities with a focus on EM and Europe

We maintain a positive outlook on credit risk, while keeping duration neutral and favouring targeting spread premia to capture income opportunities. Although volatility may persist, we expect defaults to remain at historical averages rather than rise sharply. While spreads appear tight, it’s important to recognise the improved quality of today’s high yield market along with shorter duration – around three years versus the historical four – and reference government bonds are more volatile and lower quality than in previous cycles, making historical comparisons less relevant.

Regionally, we see the most interesting opportunities in emerging markets and Europe, where policy support and attractive yields stand out in our view, and we remain underweight the US. Sector-wise, we favour continental European real estate, US media and aerospace and defence, which we believe are well-positioned for current conditions. In contrast, we remain cautious on automotive original equipment manufacturer and utilities given structural headwinds and high capital requirements.

Outlook – why we believe high yield remains attractive

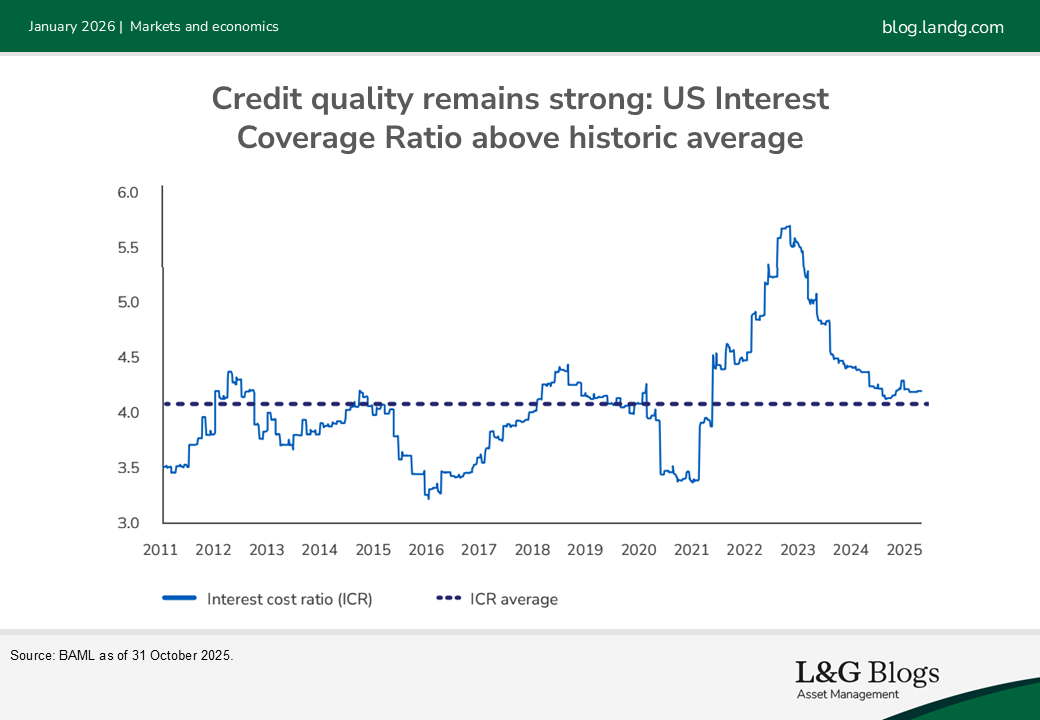

Global high yield looks set to remain well-supported as we enter 2026. A stable macro backdrop, falling interest rates, and robust corporate fundamentals, in addition to historical interest cost ratios that are above historic averages, could collectively continue to underpin the market.

Default expectations are anchored at historically low levels, creating an environment where we believe selective risk-taking can be rewarded. We are leaning into higher-spread opportunities with limited levels of risk, while steering clear of structurally challenged sectors such as autos. Global high yield has performed strongly in 2025, driven by resilient earnings and sustained demand for yield, both of which have reinforced confidence in the asset class. Against this backdrop, our outlook for the asset class remains constructive, reflected in our decision to maintain our positive score of +1.

Key risks to watch

- Policy shifts and geopolitical tensions: Unexpected changes in policy or global events could tighten financial conditions. A mild US recession on its own is unlikely to drive a surge in defaults, but a broader breakdown in credit transmission would present a more serious challenge, in our view.

- Resurgent inflation: A renewed rise in inflation remains the key threat to yield demand and carry strategies. While high yield’s shorter duration could help to provide relative resilience in a stagflationary backdrop compared to other fixed income sectors, we believe overall returns could be more muted.

- Supply may rise: Issuance is expected to rise in 2026, a result of low and falling central bank rates, a solid economic backdrop and ongoing demand for yield. Mergers and acquisitions, leveraged buyouts and spinouts are likely to increase across developed markets. There is also the need to fund digital infrastructure, particularly data centres. While this will fall mostly on investment grade and private credit markets, expectations are for 5-10% of US high yield supply next year to be datacentre-related.

This article is an extract from our Q1 2026 Active Fixed Income Outlook.

Key risk

Assumptions, opinions, and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts made will come to pass. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.