Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Hot commodities

After a five-year bear market, commodities are showing signs of recovery with record inflows. What has driven this recent strong performance?

Commodities are largely driven by factors that are not necessarily connected to the ones driving equities and fixed income markets. As a result, their returns tend to be less correlated with traditional asset classes, serving as a tool for portfolio diversification by potentially reducing overall portfolio volatility and providing some inflation protection.

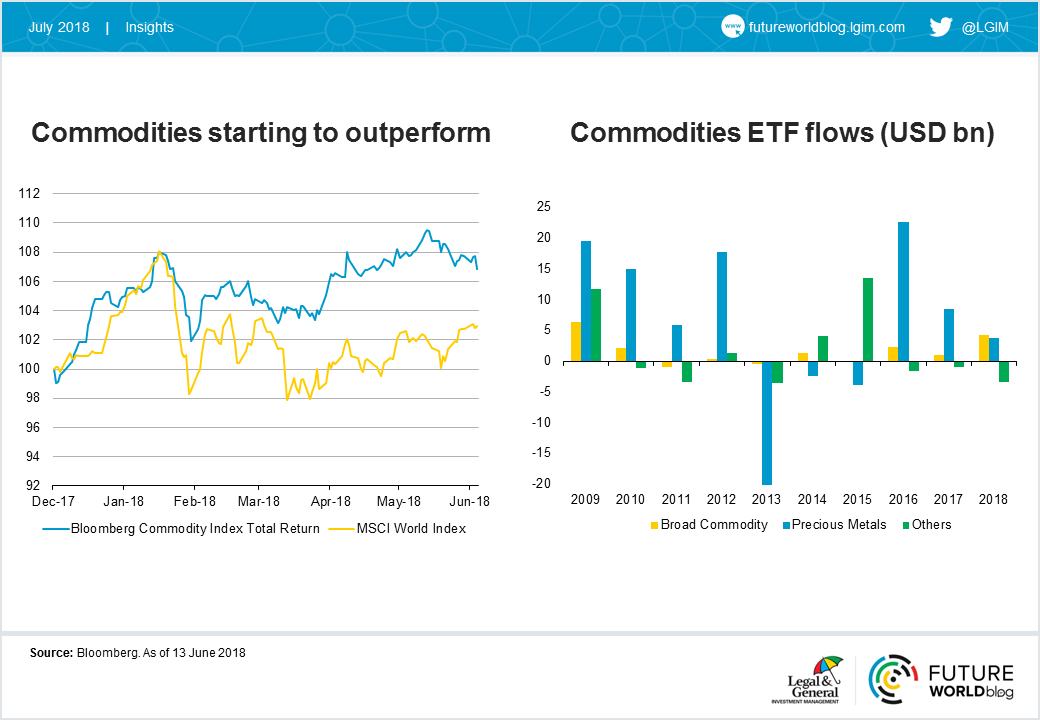

So far in 2018, broad-based commodity exchange traded funds have seen global inflows of just under $5 billion, on track to becoming the strongest year ever. These are typically held in a strategic portfolio (buy and hold) and if the trend continues, the potential flows in the second half should help 2018 flows exceed 2009’s peak of $6.5 billion. Gold has also witnessed relatively strong inflows this year, but still less than a quarter of its record 2016 flows of $23.5 billion.

Primary drivers have remained favourable thus far in 2018, with a focus on Chinese data, US bond yields, inflation and the US dollar

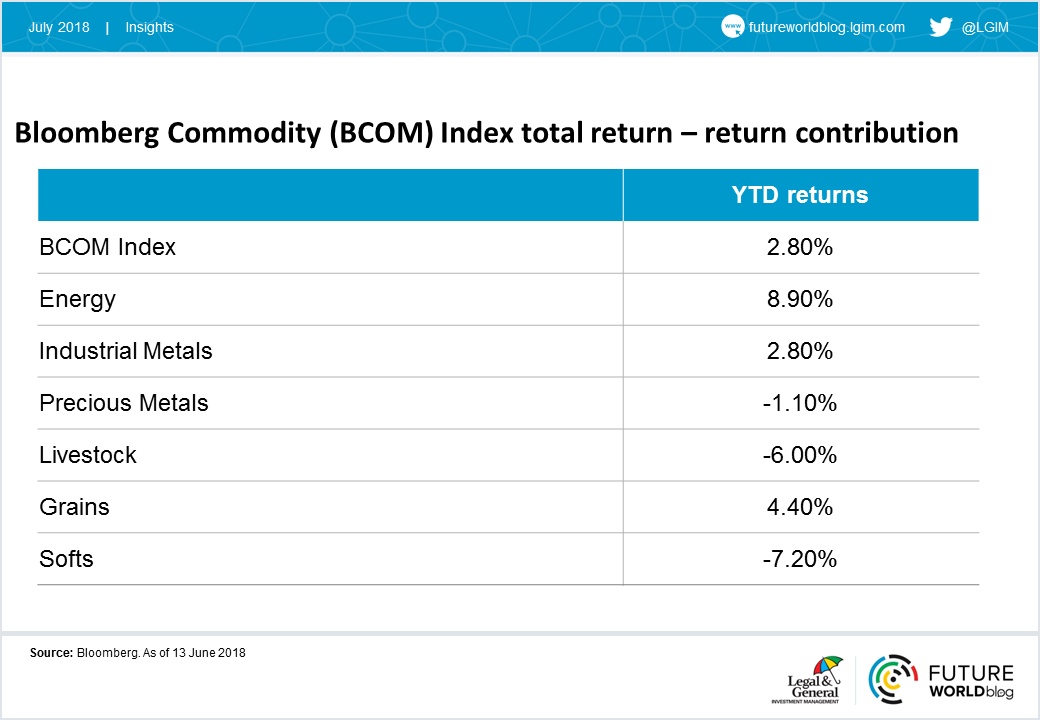

Energy has been the largest contributor to the 2018 broad commodity index's total returns, followed by grains and industrial metals. Industrial metals outperformed on the back of stronger-than-expected manufacturing data from China and they might continue to contribute further towards the overall returns, particularly if the weak US dollar trend resumes. Grains gained as global inventories contracted more quickly than expected and as supply-side constraints reduced the harvest potential amid a strong demand environment. Gold has suffered over the last two months, primarily due to a US dollar recovery and higher US treasury yields.

Oil prices could remain affected by supply-related uncertainties as a result of the proposed US sanctions on Iran and implementation of agreed production targets by the Organisation of Petroleum Exporting Countries (OPEC) in Vienna. After President Donald Trump's decision to walk away from the Iran deal in May, the sector quickly managed to gather some positive momentum, potentially because of higher geopolitical risks and concerns around shrinking supplies from Iran and Venezuela. Subsequently, as talks of Saudi Arabia and Russia increasing their output emerged, the market corrected slightly.

If global growth picks up, we expect economies to consume more resources and put upward pressure on prices

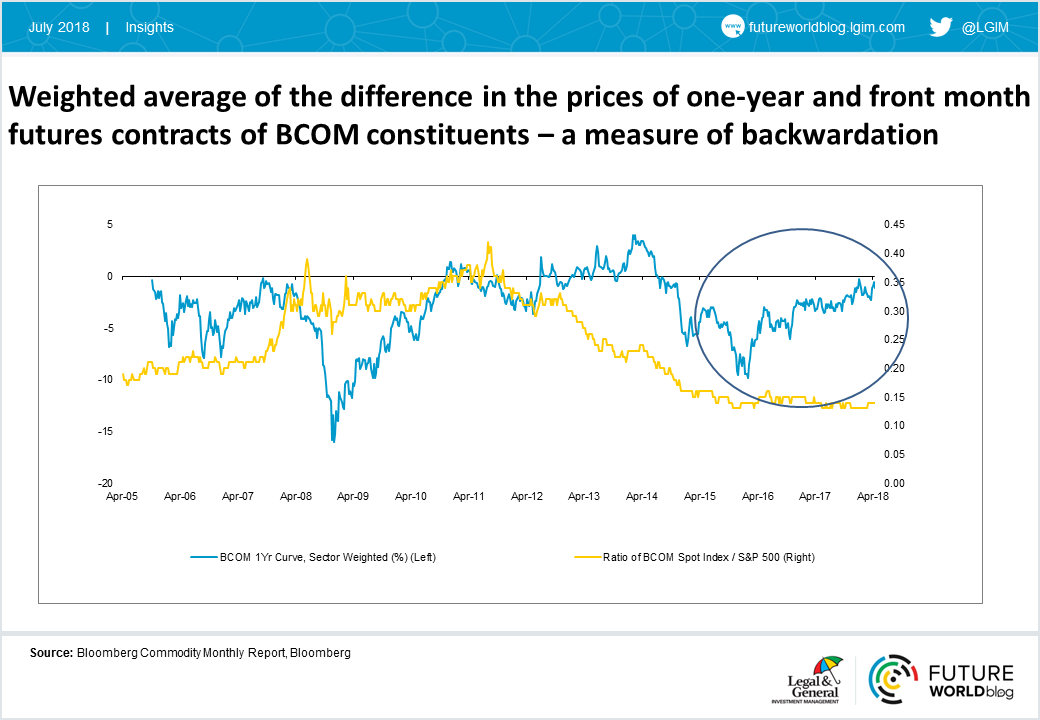

We believe that the combination of favourable supply and demand dynamics and a recovering CBOE Volatility Index (VIX) is likely to continue to support commodities versus stocks and bonds. With broad-based commodity indices, the weighted average of one-year futures curves for Bloomberg Commodity Index constituents is in a strong trend toward backwardation, which suggests favourable supply and demand conditions. Broadly speaking, backwardation indicates that the prices of futures contracts expiring sooner are higher than the ones expiring later. As a result, a long position on a later-dated contract could be beneficial to an investor as its price may increase with time as it moves closer to its expiry.

Flattening futures curves, increasing open interest, reduced speculator long liquidation risks and a bottoming VIX portend more positive days for commodities in our view. Historically, similar conditions in these key gauges marked the foundation of significant commodity outperformance over equities. If growth continues to pick up in the global economy, I expect economies to consume more resources to continue expanding, and that demand to put upward pressure on prices.

However, as central banks enter into a phase of quantitative tightening, we must also consider the possibility that growth plateaus or enters into market correction territory. Given the correlation between commodities’ performance and rising global growth, a 20-30% correction in equity markets could have marked negative consequences for flows into commodities.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.