Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

The ‘what’ of climate action investing

Focusing on high not low-carbon stocks via active ownership and investment.

The following blog is an extract from our latest Climate Solutions paper: Climate change: Inaction is not an option.

Many climate-conscious investors have historically focused on selling high-carbon stocks while potentially allocating capital to those companies that either already are, or are perceived to be, well positioned as future winners. Working in partnership, LGIM and AP7 are aiming to take a different approach.

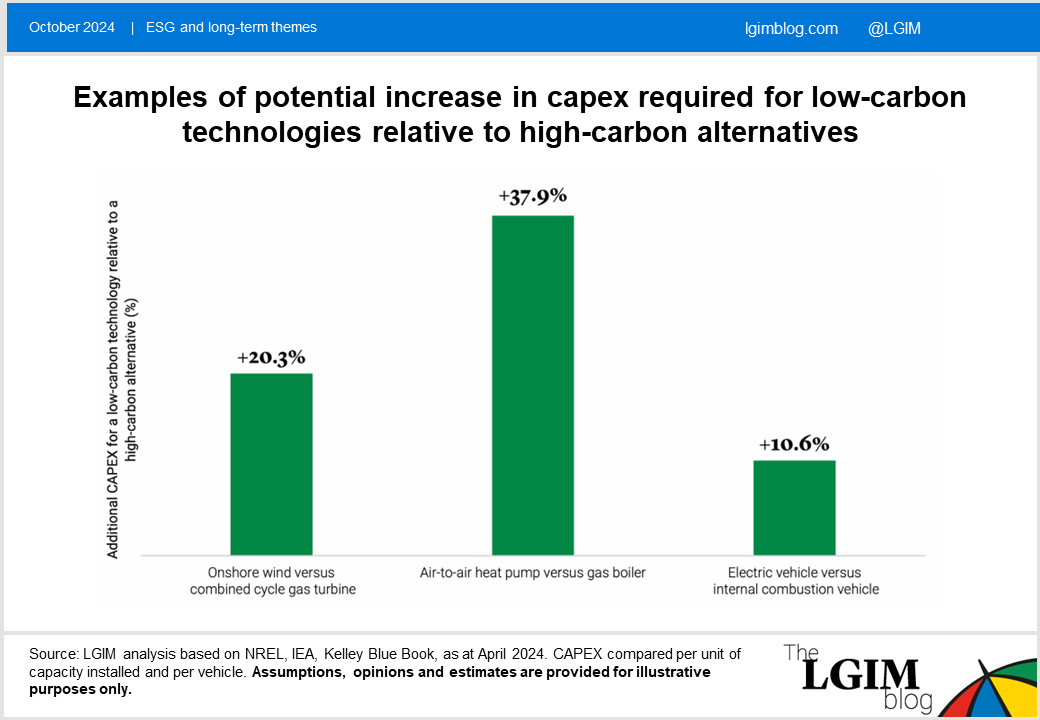

Our estimates suggest that the overwhelming majority of companies where investors can have a significant positive impact on future decarbonisation are not in those stocks that are already low carbon – but in those that are high carbon today, but with the potential to decarbonise in future. This is where our new approach focuses. Furthermore, aside from the potentially positive effect on financial metrics[1], almost all decarbonisation is likely to be capital-intensive. Whether it is replacing a petrol-powered car with an electric vehicle (where the upfront cost is higher, but ongoing running costs are lower) or building a wind farm (where capital costs are higher upfront and variable operating costs far lower), building a low-carbon future looks set to require huge injections of capital (see chart below).

Estimates vary, but LGIM’s research suggests an incremental $10+ trillion[2] of net new capital will be required to be invested into our energy system over the next 30 years to drive this real-world decarbonisation.

LGIM firmly believes in harnessing the combined power of active engagement and active investment to seek to deliver benefits for investors, whether they choose to invest in an active way, or via more traditional index strategies. While they differ in their approaches, in many ways our research suggests that they have the potential to be complementary.

For instance, if companies respond well to positive engagement, deliver effective change, and are rewarded for it, then that could not only potentially deliver significant shareholder value for those investors with focused exposure to those companies, it could also create a virtuous circle that incentivises other companies to follow, be that in the same markets or elsewhere in the value chain, both upstream and downstream of the targeted company.

Cumulatively, this potentially virtuous circle implies that pro-active and profound engagement could deliver value for all investors – whether they be a universal index owner or an active climate-solution focused investor – as well as accelerate global decarbonisation as companies improve their focus on lowering emissions.

The above blog is an extract from our latest Climate Solutions paper: Climate change: Inaction is not an option. This paper is jointly authored by LGIM’s Climate Solutions team and AP7. The views and approach expressed within this paper relate specifically to their mutual investment strategy.

[1] Source: LGIM analysis based on NREL, IEA, Kelley BlueBook, as at April 2024. CAPEX compared per unit of capacity installed and per vehicle. Such as share prices in the event that investors perceive accelerated decarbonisation to be a net positive. Assumptions, opinions and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts made will come to pass.

[2] Source: ibid

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.