Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Uncertainty abounds

With geopolitical tension rising, we consider a fundamental choice confronting investors, and what it takes to remain objective.

The following is an extract from our CIO spring update.

In our latest Asset Allocation Outlook, we discussed the factors driving the surprising resilience of the US economy. Yet the US must tread a narrow path to rebalance smoothly and then stay at equilibrium.

We see a wide range of possible outcomes. Growth could still slow unexpectedly as the tailwinds fade, revealing that monetary policy is tight after all; or ongoing fiscal support, alongside a revival in private sector credit and business investment, could keep the economy running hot. Overall, inflation risks appear tilted to the upside given limited economic slack.

The situation across Europe is somewhat different, given less fiscal stimulus and more adverse supply shocks. After a period of stagnation, growth seems likely to recover gradually through the course of the year. Falling headline inflation is providing some relief to squeezed real incomes and banks are no longer tightening their lending standards.

The European Central Bank (ECB) has guided expectations for a June cut and seems determined not to be constrained by the Fed. The appetite for patience is more limited than in the US given the current lack of growth momentum.

The Bank of England would like to follow the ECB, but might find that sticky core inflation and stubbornly strong wage growth make it hard to justify any premature easing of the restrictive monetary policy stance.

Any European recovery remains fragile and is vulnerable to shocks. Another bout of inflation risks de-anchoring existing expectations and will make it hard for central banks to offset the hit to real incomes and any adverse reaction in financial markets.

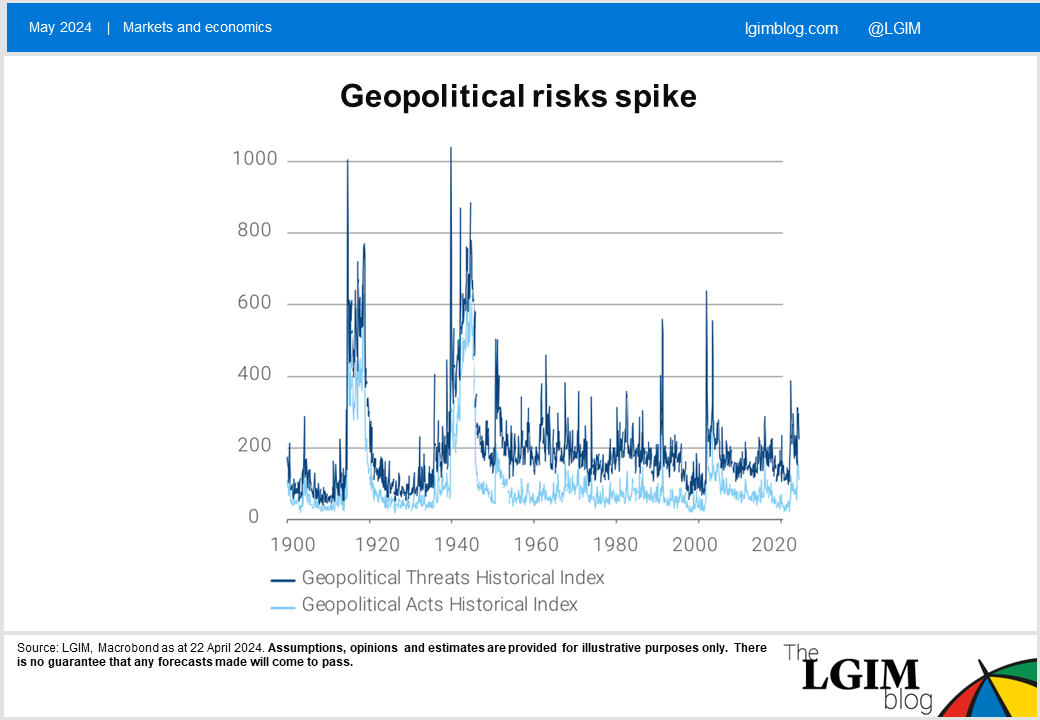

Geopolitics could provide that destabilising shock, as noted by Sonja, with investors increasing their focus on tensions in the Middle East and the potential fallout from multiple elections scheduled for this year, not least in the US.

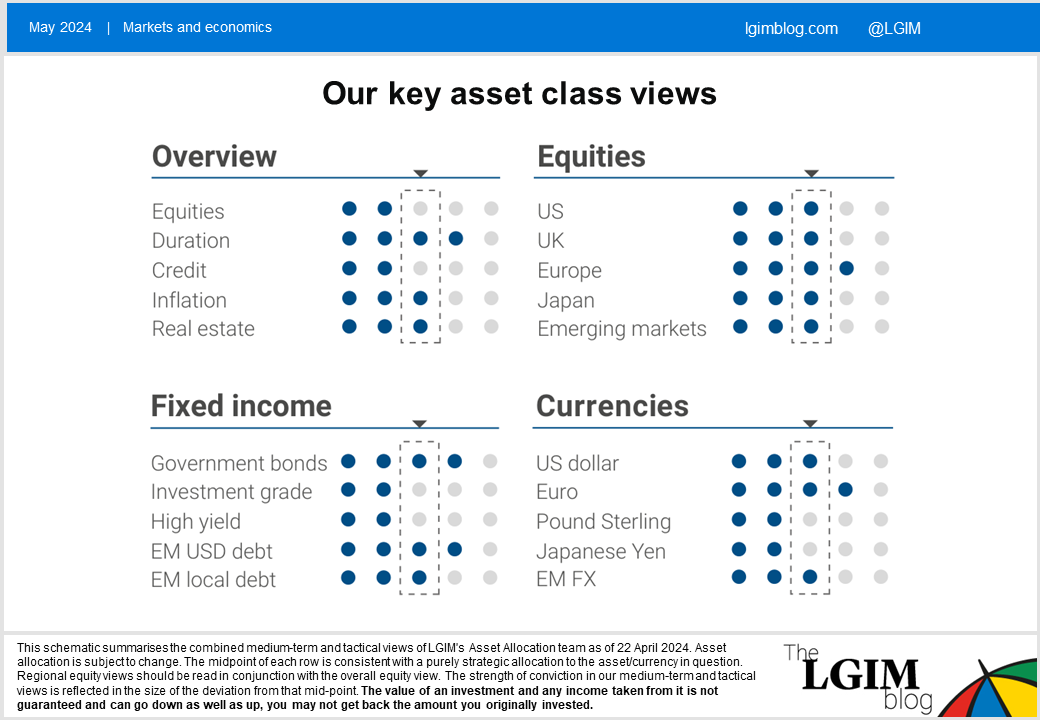

As a result, our posture across portfolios is broadly defensive, with an underweight to equities and credit. We are also somewhat overweight duration.

The rates outlook

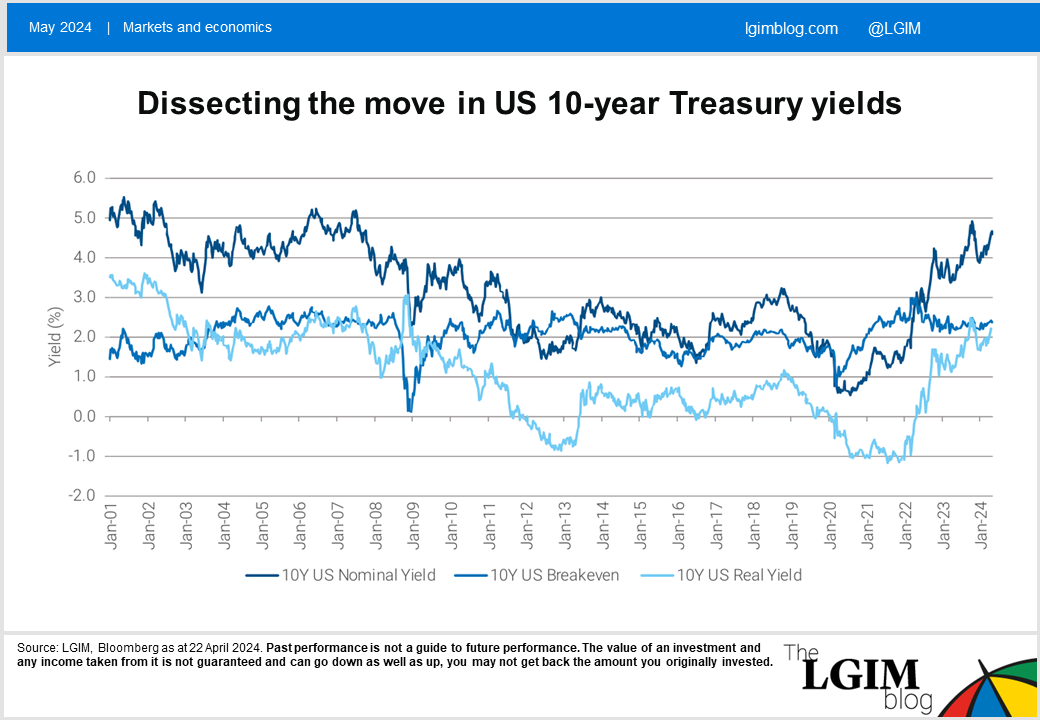

The performance of yield-sensitive assets in the first quarter was uncomfortably reminiscent of the selloffs of 2022 and 2023. We saw rising nominal yields in almost all major markets as investors reassessed the prospects for rate cuts in the second half of the year.

That, in turn, undermined the case for assets competing with government bonds for investor flows. There are a few points that we would draw out within the broader picture of rising yields:

1. US Treasuries remain the overwhelmingly dominant return driver. Despite the ongoing malaise in European and UK growth, and some central banks talking up the prospects of imminent rate cuts, global bond markets have marched to the beat of the US drum. We’ve highlighted that dependence before, with approximately 80% of the volatility in gilts and bunds explainable by developments in the US market, according to our research. Divergent economic prospects have played only a marginal role in influencing yields.

2. Due to the ongoing resilience of the US economy, the market is increasingly questioning assumptions about neutral interest rates, not just the likely near-term path. The aggressive curve flattening that was previously associated with rising yields has been replaced by a glacial steepening. From the perspective of risk assets, we believe that so-called bear steepening is likely to be less damaging as it implies confidence in higher sustainable interest rates rather than fears of central banks overtightening. Expectations of higher trend growth flow from both stronger-than-anticipated immigration and the tantalising hope of AI-driven productivity enhancements. Equally important has been the robustness of corporate cashflows to higher yields, given large cash piles among the largest stocks and the absence of rapidly resetting mortgages in the US.

3. Inflation forecasting remains a thankless task. Weak US core inflation, on a sequential basis, in the last quarter of 2023 gave way to a series of stronger numbers in the first quarter of 2024. It is very hard to know whether that is attributable to problems with seasonal adjustments or a genuine reacceleration. Our bottom line is that the process of disinflation continues. Most importantly, we see slack slowly building in the labour markets on both sides of the Atlantic. However, hysteresis will continue to frustrate those hoping for a rapid normalisation. Patience will be required as yesterday’s inflation shock continues to propagate into strong wage and rent growth.

Fiscal promises

As we move through 2024, market attention will increasingly gravitate to the pending US election and the fiscal promises of the major parties. Neither party is offering a model of fiscal restraint with the debate rotating around whether to spend more money or cut taxes. Political voices calling for the opposite path are finding little traction in the current environment.

Prepare, don’t predict

Geopolitical events are incredibly hard to predict. In many cases investors are attempting to forecast the idiosyncratic decisions of a few governments, where power can be concentrated among very few individuals. Yet the prominence of geopolitical events, their emotive nature, and their perceived near-term impact on markets make them a hotbed for behavioural biases to emerge, which complicate the decision-making process, often in a destructive way.

Our investment process for these events is centred around our motto: “prepare, don’t predict”. We emphasise building resilient portfolios that aim to deliver the long-term objectives of our clients, withstanding a range of economic outcomes. We prefer to survive through all scenarios, rather than thrive in just one.

That means seeking to build diversified portfolios and conducting significant scenario planning in advance; during geopolitical risk events themselves, it involves drilling down to the fundamentals of how growth, inflation and corporate earnings may be impacted.

To hedge or not to hedge

Should the action bias be too much to resist, a significant choice confronts every investor: whether to hedge against geopolitical risks or to try to capture risk premia that may be present. For many, the gut reaction is to hedge, by reducing exposures to potentially impacted asset classes, or adding to protective allocations.

This option is often satisfying; it feels good, reduces stress and is easy to communicate to clients. But equally, this approach may reduce portfolio diversification, be costly as some of the risk has already been priced into markets, incur costs, and ultimately reduce expected portfolio returns.

This leads to a different perspective that invites us to rethink our strategy towards these risks. While taking positive exposure to each geopolitical event might pose an asymmetric risk – small gains if the risk doesn't materialise, against large losses if it does – a repeated engagement with these risks can yield a premium.

In our view, this type of contrarian strategy can potentially reap rewards for certain investors. A health warning is needed, however: this strategy requires a steady hand and a robust process.

The above is an extract from our latest CIO spring update.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.