Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Tequila sunset: is the Mexican peso’s run coming to an end?

Low unemployment, retail sales outpacing manufacturing and a deteriorating trade balance all indicate Mexico is overheating, suggesting the peso could weaken.

The Mexican peso has had a spectacular run recently. It has rallied incessantly since October 2022, and is now up 17% against the US dollar.1 When benchmarking currencies against inflation differentials, relative productivity gains and terms of trade, we find the Mexican peso to be the most overvalued emerging market (EM) currency after the Czech krona and Philippine peso.

Of course, currencies can remain misaligned for long periods, but the catalyst for a weaker peso is forming in our view: the economy is showing signs of overheating.

Overheating can manifest itself through inflation and/or rising current account deficits. In the former case, the best response tends to be higher interest rates, which can lead to a stronger currency. In the latter case, the best remedy is typically a weaker currency, which makes exports more competitive and imports more expensive.

It looks to us that Mexico would benefit from a weaker currency.

It’s getting hot in here

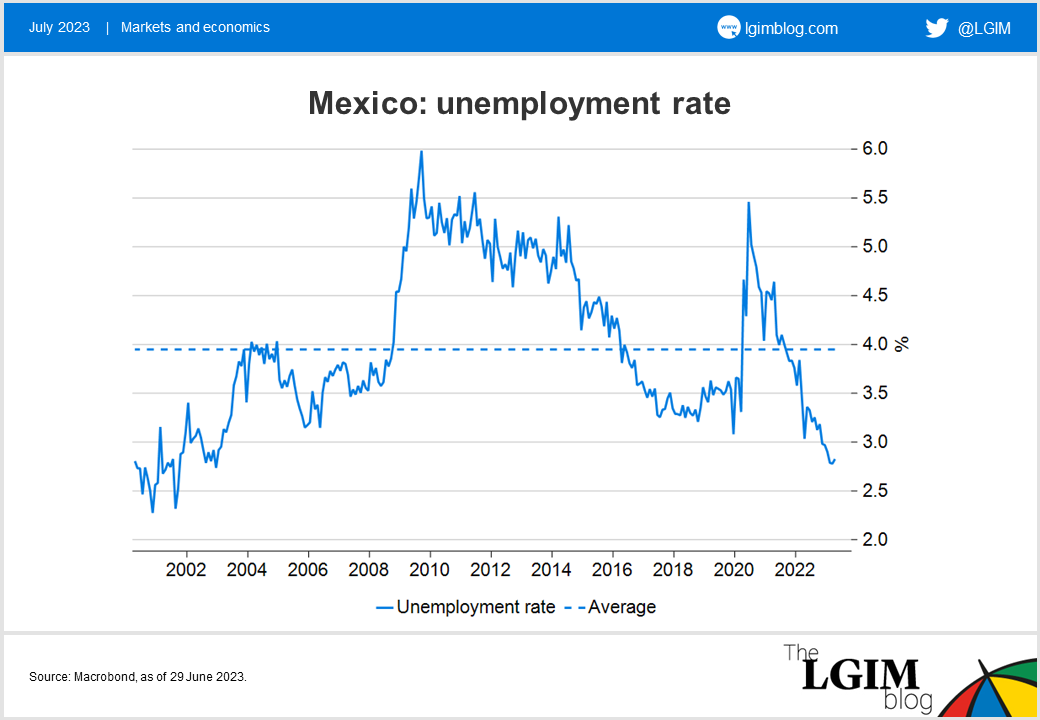

What are the signs of overheating? Mexico has had a year and a half of buoyant growth after 3.5 years of no growth (COVID-19 bounce excluded). While in the rest of Latin America (except Brazil) growth slowed in the wake of steep rate hikes, the Mexican economy steamed ahead. As a result, unemployment hit the lowest level in 20 years and capacity utilisation reached an all-time high in March.

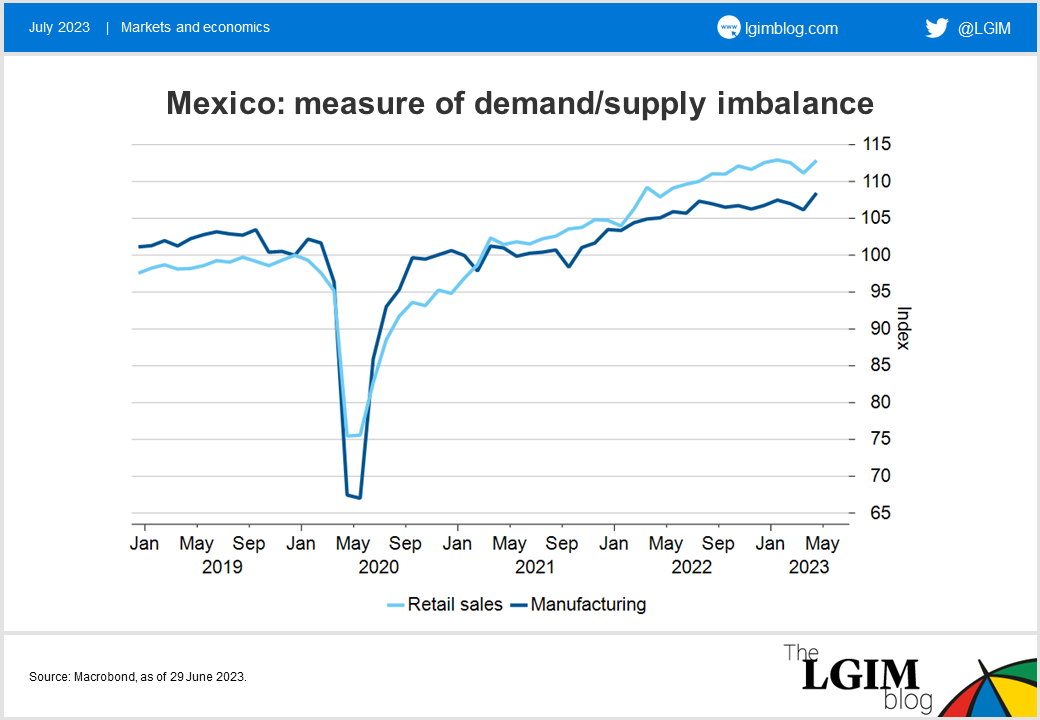

Retail sales outpacing manufacturing activity is another sign of demand exceeding supply. No other regional economy has seen such divergence, except Chile where imbalances have been correcting since late 2021.

Finally, and again in contrast to regional peers, Mexico’s trade balance has been deteriorating. On the export side, this is driven mainly by manufacturing as opposed to commodities, suggesting that the strong peso is starting to undermine competitiveness. On the import side it is driven by buoyant consumption.

As mentioned, overheating could trigger more interest hikes, thereby, strengthening the peso even further. However, the opposite is happening. Inflation is falling and continues to surprise on the downside. After the last Monetary Policy Committee meeting markets brought forward rate cuts, the first of which could now happen as early as September.

Neighbourhood watch

What about nearshoring, which has been partly credited for the peso’s recent outperformance? Could large capital inflows lead to more peso strength?

We see clear potential for nearshoring, but it could play out over a longer time horizon. This is borne out by recent data.

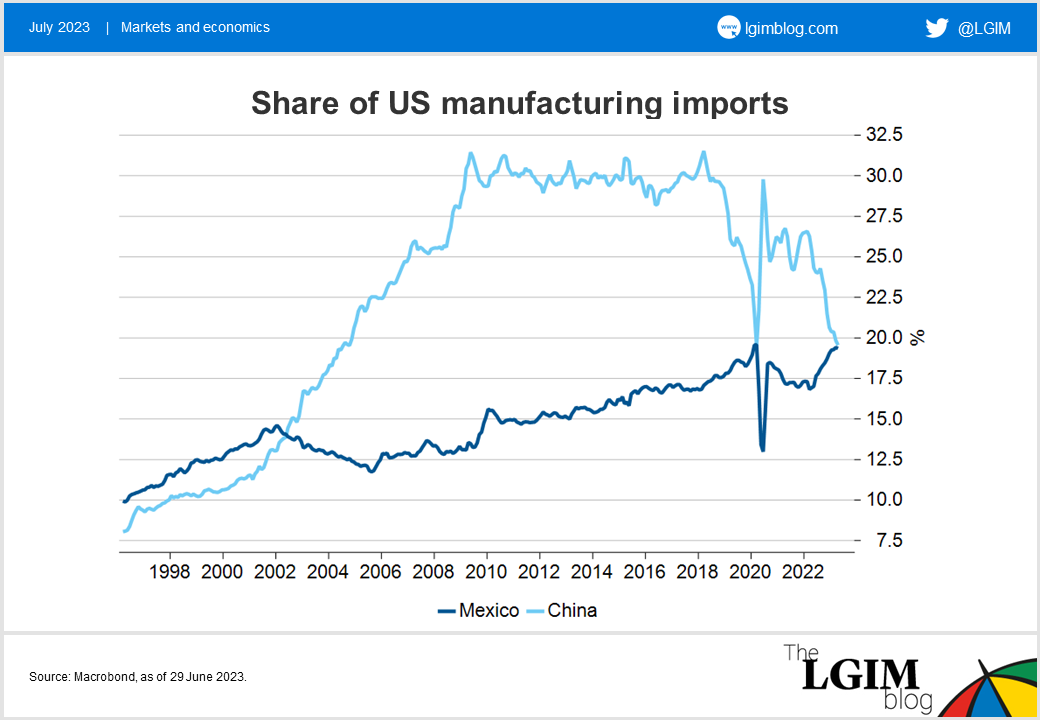

Foreign direct investment inflows have disappointed over the past half-a-year and Mexico’s share in US manufacturing imports dropped in April just when it was about to overtake China – another sign of an overvalued exchange rate?

How we’re positioning for a peso decline

LGIM’s Asset Allocation team has expressed the above view in dynamic strategies by taking a negative view on the Mexican peso against a basket of other Latin American currencies, namely the Brazilian real, the Chilean peso and the Colombian peso. This has several potential advantages. It mitigates the large negative carry that a short against the US dollar would entail. It also isolates the position from large dollar moves and makes it more idiosyncratic.

Finally, we believe that the trade has potential to perform with or without a US recession later this year, as Mexico is likely to either grow too hot or freeze over.

1. Source: Bloomberg, as of 29 June 2023.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.