Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Take a hike: what will central banks do next?

We assess the chances of a pause in the rate-hiking cycle in the months ahead, and whether the dollar can continue its strong run.

Central banks have been front-loading interest-rate hikes, with rises of 50 basis points (bps), 100 bps or even more surprising markets in recent weeks. The US Federal Reserve (Fed) is expected to be the next to do so this Wednesday, with a small possibility of an 100 bps hike following strong June prints on payrolls and inflation. But while the Fed is putting more emphasis on current inflation levels after being burnt on its ‘transitory’ narrative, there is still the possibility of a soft landing.

It may draw some comfort from some signs that growth is slowing, with forward-looking surveys suggesting a further loss of momentum is likely in the near term. Housing costs are cooling, and companies are signalling the imbalance in the labour market between excess demand and limited supply is starting to close as they reassess whether they want to fill their vacancies in a deteriorating economic environment.

The decline in commodity prices – notably gasoline prices – will be welcomed. The Fed will also be relieved that progress is being made more broadly on unclogging supply chain bottlenecks.

A brief reprieve?

If the Fed delivers another 75bps hike, as we expect, this will validate market expectations and bring the Fed Funds Rate to their estimate of neutral. Given the tightening in financial conditions already seen this year, there is probably less need, for now, to take further action that may inflict more pain on markets. Inflation expectations appear contained, so this buys the Fed some time to assess the impact of the abrupt policy pivot already undertaken this year.

So, what happens next? We believe downbeat activity indicators and softer inflation should allow the Fed to slow down the pace of tightening at the next couple of meetings. However, we also think growth should stabilise later this year as household real incomes receive a boost from lower headline inflation. But services inflation is likely to prove sticky and keep core inflation still uncomfortably far from its target.

So, the window of belief around a possibility of a soft landing could close again in 2023.

Currency battle heats up

We believe central banks understand they must match the Fed in hiking rates to stem currency weakness and are prepared to do so. Otherwise, currency weakness will only result in further imported goods inflation.

We are seeing a few more countries where real policy rates are now in positive territory, with Hungary and Chile the latest additions.

The willingness to stop currency weakness goes further than just rate hikes, and a number of central banks are using their foreign currency reserves to intervene directly or have expressed they’re close to doing so.

Calling time on the dollar

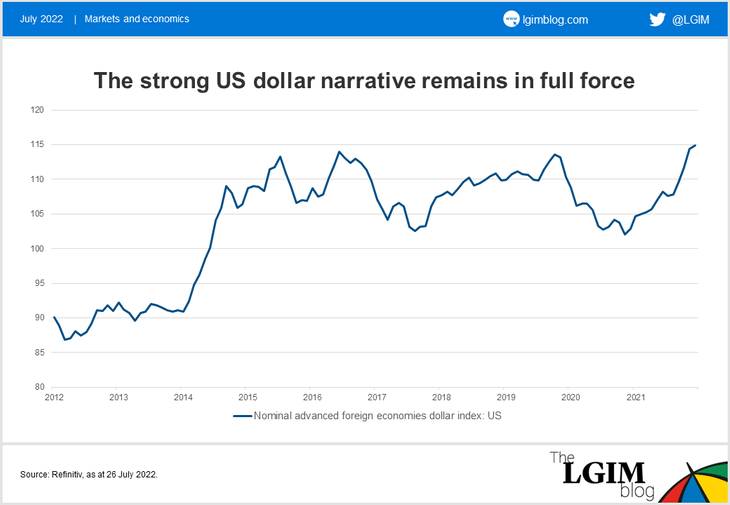

Sentiment towards the US dollar has been positive for a while now, and that didn’t stop further dollar strength. It even feels like no one is questioning the strong dollar narrative anymore, and trend-following currency strategies are maxed out on their long dollar exposure.

We have said it before – and were too early then – but in our view the dollar’s strong run may be due to fade.

If this did happen, it would also be good for risk assets, in our view. It’s a bit like a chicken and egg situation (what’s causing what?), but we believe dollar strength adds to nervousness on the risk trade through the channel of emerging market credit.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.