Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Who wants credit after the rally?

As the number of COVID-19 cases around the world continues to rise, increasing public awareness that the infection risk is still high is likely to lead to more cautious behaviour regardless of whether lockdown restrictions ease further.

For example, restaurant visits fell as the virus situation worsened in ‘sun belt’ American states, both before and after reopening rollbacks. Developments over the past three weeks have increased the danger that US consumer spending growth is about to slow abruptly and perhaps even contract through the rest of the summer.

Given this backdrop we are inclined to sell risk assets, but rather than increase our underweight equity view we have focused on US investment-grade (IG) credit.

IG gnawed

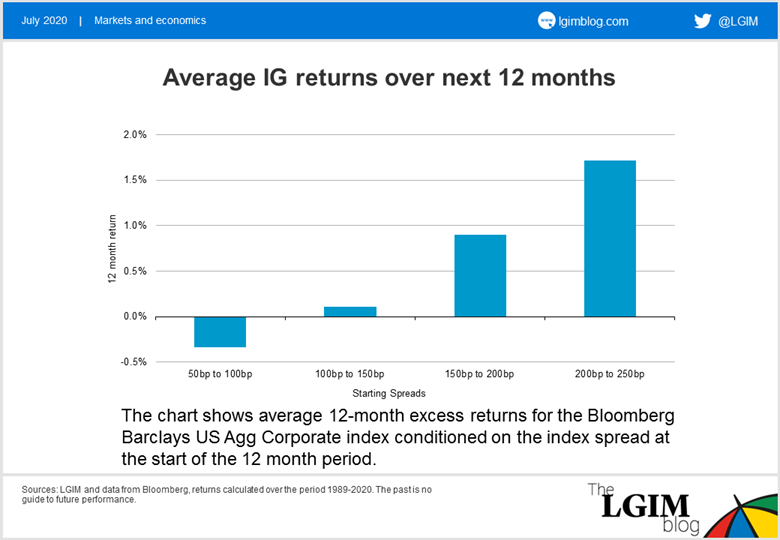

The case for reducing IG credit starts with valuations. IG spreads have recovered in line with equities, with both having recouped four-fifths of their losses. We’re now in the kind of valuation territory where credit has not been particularly rewarded in the past. From a starting point of spreads being narrower than 1.5%, the average excess return on IG credit has historically been a paltry 0.1%.

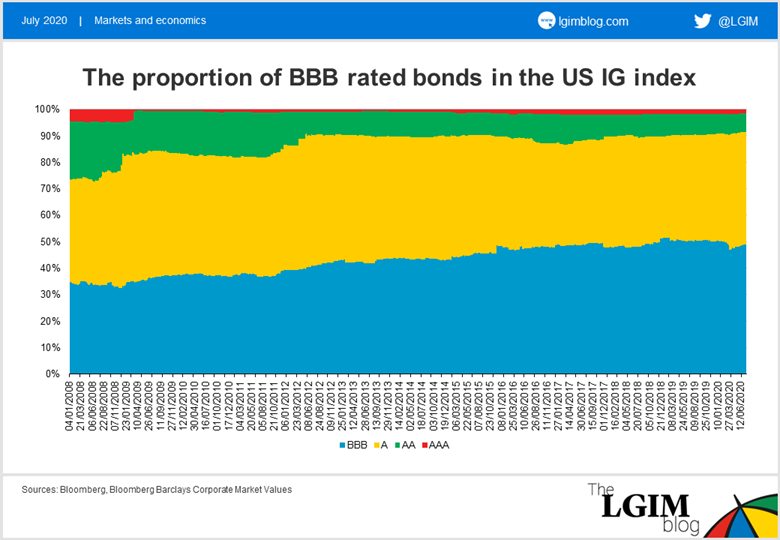

Given the deterioration in the average credit quality of the US IG index over time, there are reasons to be even warier on this front today. Since 2008, the proportion of bonds in the index with a BBB rating (one notch above ‘junk’ status) has increased from 35% to 50%. As Federal Reserve (Fed) Governor Lael Brainard noted recently, this year we’ve seen about $700 billion of downgrades of IG debt and around $55 billion in corporate defaults. That pace of deterioration surpasses that seen in the immediate aftermath of the 2008/09 crash.

We also think investor sentiment favours caution, with the consensus credit market outlook starting and finishing with “the Fed has our back irrespective of downgrades/defaults”. For example, during the final week of March – after the central bank announced the Secondary Market Corporate Credit Facility under which it can purchase corporate bonds – exchange-traded funds tracking US credit markets gained around 10%. That this happened before the Fed actually started buying the assets suggests investors aren’t really thinking about the fundamentals.

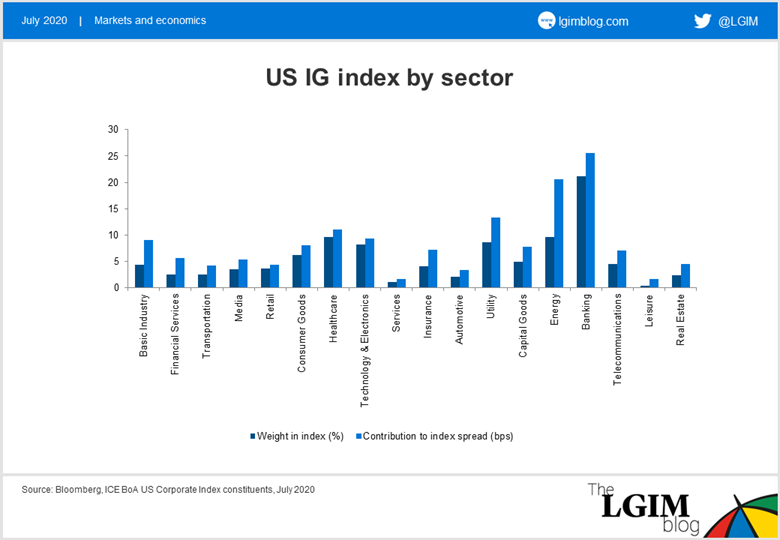

The sector composition in the IG credit indices makes it quite interesting from a short perspective too; whereas mainstream US equity indices are tech-heavy, in IG the largest sectors are banking, healthcare, and energy.

Drawing all of this together, and in light of our existing equity short, we believe a negative IG position offers diversification from both an asset-type and sector perspective.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.