Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Is credit spread widening the ‘canary in the coalmine’

How reliable an indicator of a coming recession is the widening of credit spreads?

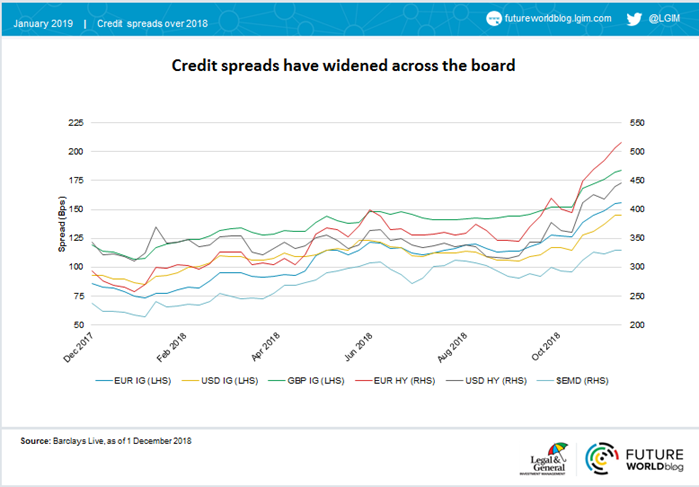

Corporate bonds have had a challenging 2018. Credit spreads widened across most geographies and credit ratings. This can be a worrying development for investors, potentially indicating that a recession is around the corner.

Widening credit spreads are symptomatic of tightening lending standards, reflecting a reduction in the willingness of banks and other lenders to provide finance to businesses and individuals. This can stifle growth and increase default risk as companies struggle to refinance. If the tightening in lending standards is severe enough, poor risk asset returns and recession tend to follow.

Does the data back the theory?

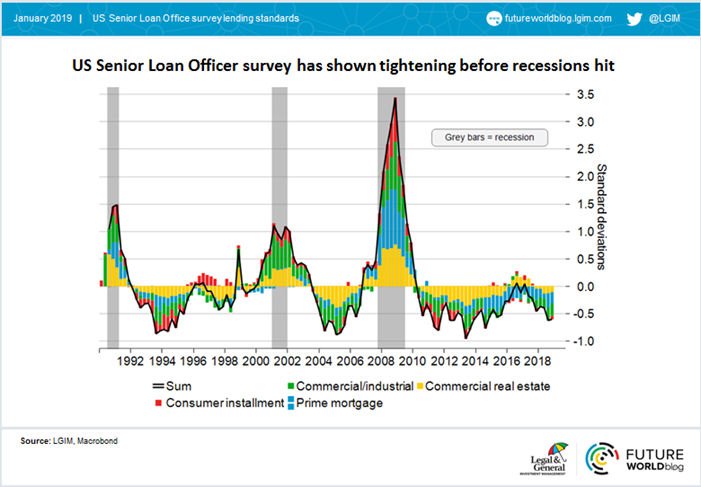

On the whole, yes! A key metric economists look at to ascertain the availability of credit is the US Senior Loan Officer Opinion Survey and the chart below highlights why. When the line is above zero, this highlights that there is a tightening in lending standards. It can be seen that in advance of each of the last three recessions, lending standards tightened, flashing an advanced warning that recession was imminent.

However, while the data shows that recessions have always been preceded by a tightening in lending conditions, they will not always lead to a recession. The most recent evidence of this was in early 2016, where the collapse in the oil price and concerns about a Chinese hard landing led to volatility in markets, a pick-up in defaults in the energy sector and a mild tightening in lending standards. However this did not lead to a recession, with central banks maintaining loose monetary policy, oil rallying and China stabilising. Additionally, as described in Tim Drayson’s article, one has to be wary that the higher profile of this and other lending surveys led it to succumb to Goodhart’s law.

Is it time to panic?

Not quite yet. While it looks like we are late in the economic cycle in the US, there seems to be a low risk of recession in 2019. While it has been a bad year for credit, spreads were narrow at the start of the year and now are broadly in line with the long-term average. Indeed, eagle-eyed readers will have noticed that the senior loan officer survey currently is still in expansionary territory and is therefore not signalling difficulties for businesses obtaining credit.

'Fed put' in hibernation?

Since the financial crisis, episodes of significant volatility have often been followed by accommodative central bank action (colloquially known as the ‘Fed put’). With the end of quantitative easing in Europe and the US hiking rates, there are concerns that this might not remain the case in the near future. However, while inflation pressures are building in the US, the Fed still has room to pause if data disappoints or markets continue to fall.

So what does this mean for my portfolio?

The volatility of recent weeks has led many investors to be concerned on the outlook for the global economy and I recognise there are significant risks on the horizon. While recession does not appear imminent, we are late in the economic cycle and there are bigger barriers to buying market dips. As such, it is important that investors are increasingly vigilant. Credit spread widening and a tightening in lending standards have historically been key indicators that the global economic outlook is deteriorating and could prove significantly important for investors looking to protect themselves from the next downturn.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.