Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Should investors worry about rising yields?

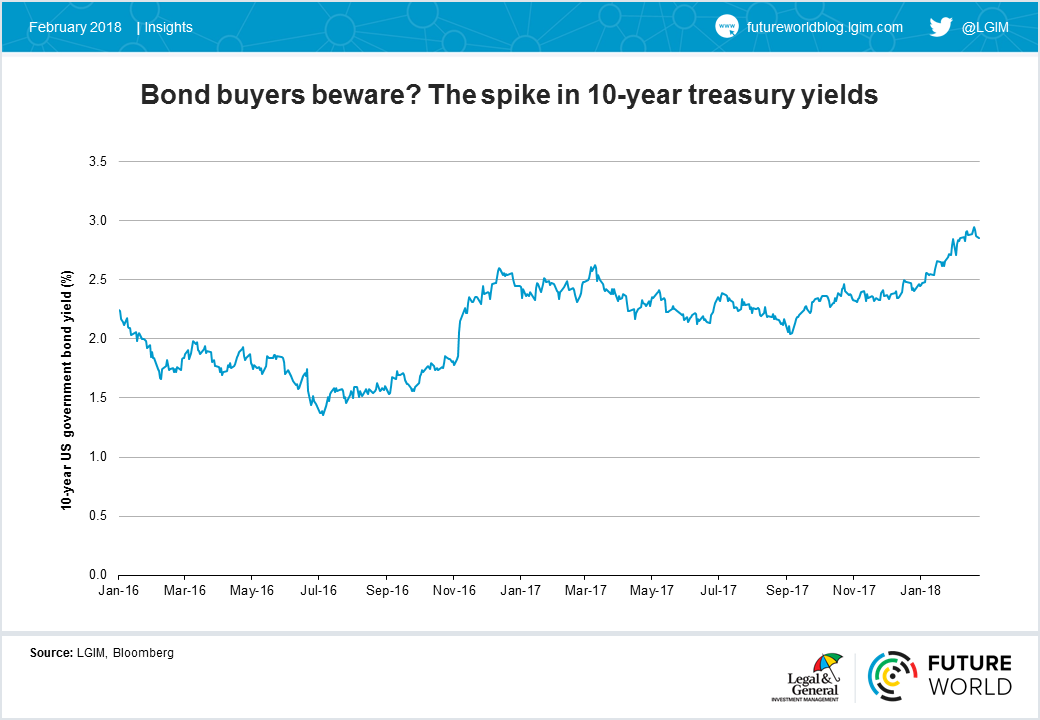

The rise in yields has accelerated, equity market volatility has spiked, and the bond vigilantes are stirring. Should we be worried?

What a difference a new year makes. Those hoping for an exciting start to 2018 have not been disappointed – bond yields, particularly in the US, have risen sharply in response to the greater US fiscal stimulus coinciding with strong US economic data and sharply rising equity market volatility.

The rise in yields caught investors’ attention as it was accompanied by a huge spike in equity market volatility

The market mood darkened in early February, with equity markets doing an about-turn. Indeed, the rise in yields caught investors’ attention not just because of the corresponding decline in government bond prices, but also because it was accompanied by a huge spike in equity market volatility. Higher rates have also led to credit market losses, although the market’s required compensation for default and liquidity risk (i.e. corporate bond spread) is only modestly higher.

As discussed in UK yields to stay low?, our long-term view is very much that the combination of structural forces including weak demographics and the high debt burden will cap the extent to which yields can rise across developed markets, particularly in real terms. We also believe that there is a significant amount of capital, both domestic and international, that is likely to seek a home in bonds should yields remain high.

Higher rates have also led to credit market losses

However, this does not exclude the current dynamic of a cyclical rise in yields, as tight labour market conditions finally feed through into higher wages. Fears of rising inflation could spread across a number of developed markets in the coming months, buoyed by robust commodity markets. Importantly, given the amount of debt in the system, any short-term rise in yields has the potential to cause significant volatility in risk assets – as has been seen over the past few weeks – and we therefore remain cautious on global credit markets.

While they haven’t blinked yet, a material and lasting decline in risk assets should eventually prompt a reversal of recent monetary tightening by the major global central banks.

Any long-term decline in risk assets would likely prompt a central bank reversal

With so much debt in the world and yields still very low in a historical context, there’s a good argument that government bonds are the world’s biggest bubble. But given the serious economic ramifications of a structural rise in yields, we believe that policymakers will try everything to stop the bubble bursting, and their supportive actions usually end up inflating it even more.

So while government bond yields could continue upwards for now, we don’t believe this is the start of a trend where they move significantly higher.

Those bond vigilantes may have to wait a while yet.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.