Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Pinning the tail on the donkey

The output gap is one of the most important concepts for macro investors. Unfortunately, it is very difficult to measure in real time.

Before children’s parties became a financial competition among parents, we used to play simple games. My favourite was being blindfolded and then spun around a few times before trying to find the correct spot for some appendage on an animal picture.

Economic forecasting feels remarkably similar except without the sweets at the end. For those that are wondering after reading my new year resolutions, I have gone for unpalatable option 2 and have capitulated to consensus on US growth.

But it seems I am not the only economist struggling. According to a well-known search engine, the US Congressional Budget Office (CBO) employs 270 staff, mostly economists with advanced degrees. They are tasked with providing independent budget forecasts based on current legislation to help inform policymakers.

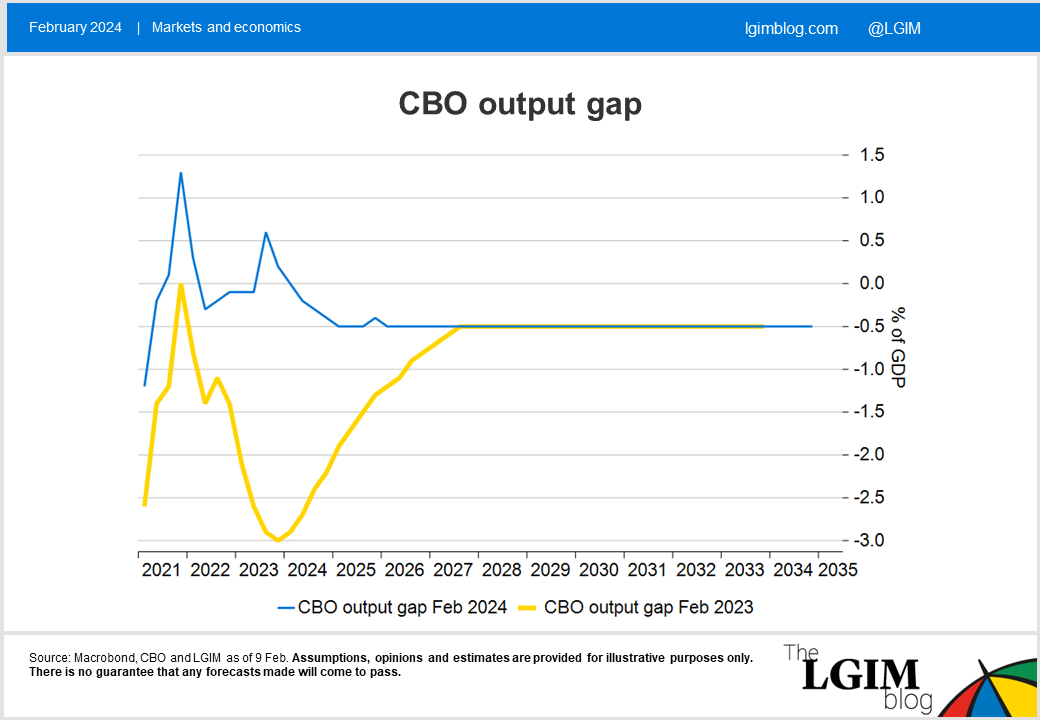

Longer-term budget projections hinge critically around economic assumptions as this drives future tax receipts. In particular, the CBO needs to estimate the economy’s potential growth and the output gap, which is the difference between the current level of output and the economy’s maximum sustainable output.

In theory, when the output gap is negative, stimulus can be applied to boost growth (and revenues) without generating inflation. But with a positive output gap, a period of weak growth or recession is necessary to keep inflation in check. The output gap can also map onto potential future asset price returns, so it is important for investors to consider.

The CBO recently updated its projections, and they reveal a series of misjudgements:

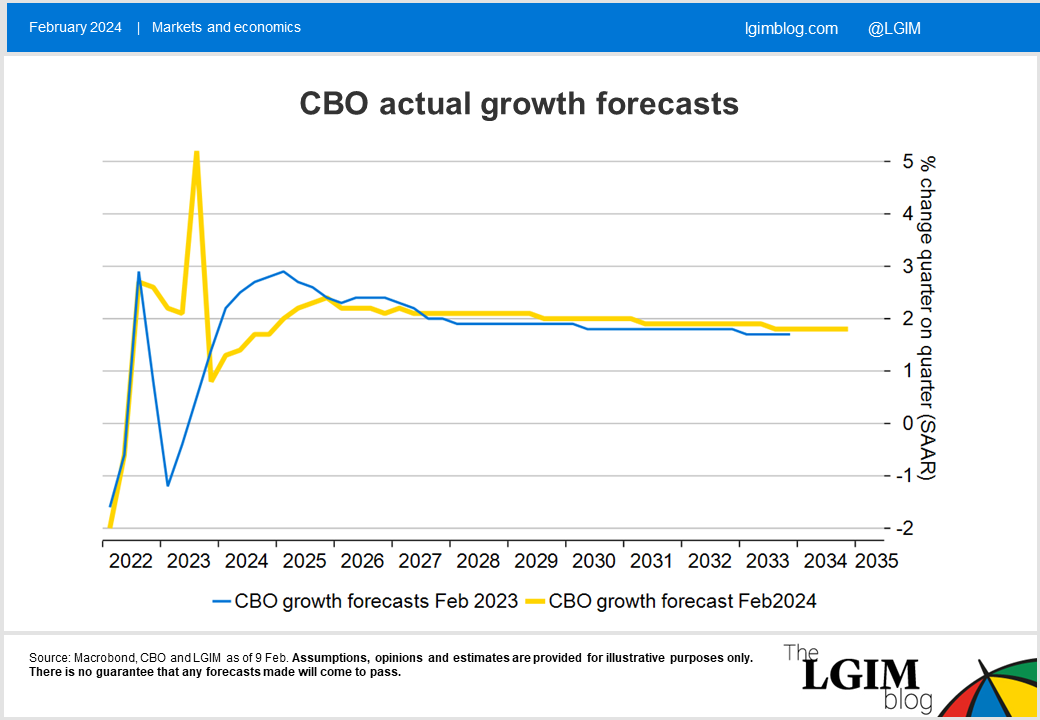

- The recession they forecast for 2023 never materialised; instead the economy performed remarkably well

- The deficit in the 2023 fiscal year came in about $600bn (>2% of GDP) wider than expected (adjusted for student loan accounting). Normally, stronger-than-expected growth should lead to narrower deficits, though in this case, the unexpected fiscal stimulus is partly responsible for the stronger growth

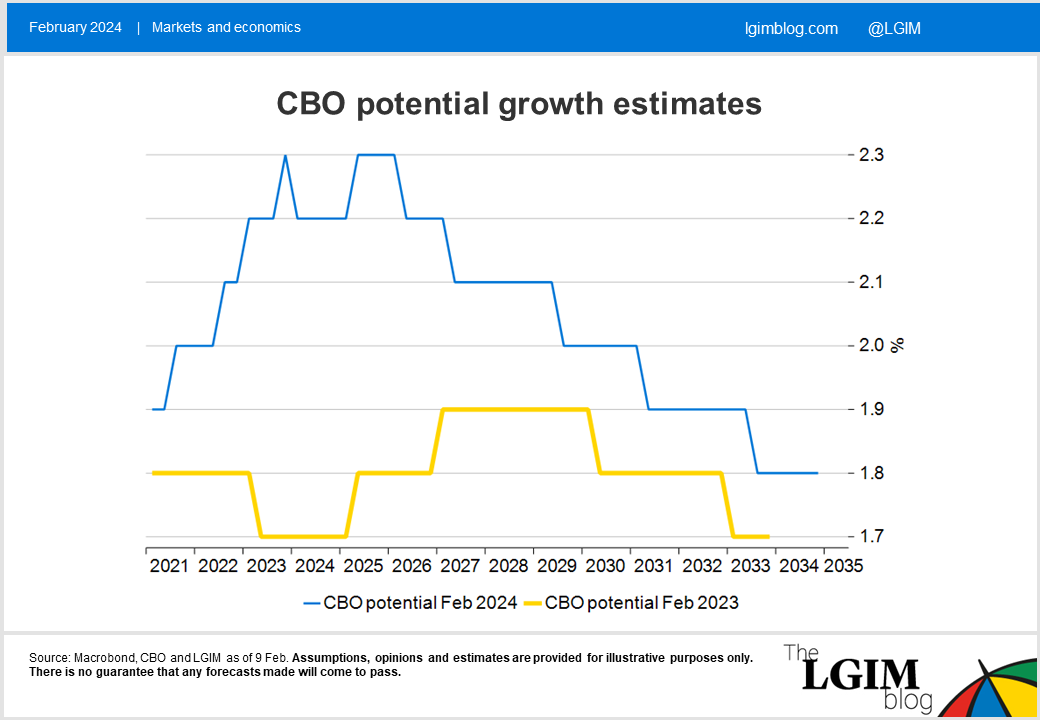

- Looking ahead, they now forecast much stronger potential growth. This is almost entirely due to an unanticipated surge in immigration, which is expected to continue. This could be good news for the deficit as it means more future revenues

- However, the CBO have also reassessed the starting point for the output gap and now see a lot less slack at the beginning of 2022 and a positive output gap at the end of 2023. So this weighs on future growth, despite stronger potential growth

The net result is the medium-term budget projections are broadly unchanged, with deficits ranging from 5-6% over the next decade. The debt path remains unsustainable, in our view, reaching 116% of GDP in 2034 from near 100% today. The reality is likely to be far worse given the assumption that there won’t ever be another recession and that none of the additional tax and spending measures currently being debated make it through Congress and all the Trump-era tax cuts expire.

The whole exercise also reveals the challenge in trying to calculate the output gap in real time. That is why you won’t find estimates of the output gap featuring much in our analysis of the economy. Price and wage growth are the ultimate determinants of whether the economy is operating above or below capacity.

We know that they are hard to predict, but various lead indicators can provide useful hints about their trajectory in the near term. It is only after completing an economic cycle that the blindfold is truly taken off. That might be useful for economic historians, but it is unhelpful for investors.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.