Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

New year resolutions of an economist

I was wrong about a US recession last year and while some of the risks are receding, the market is probably complacent to believe in a seamless adjustment to equilibrium.

New year resolutions defy rationality. If the marginal benefit exceeds the marginal cost it stands to reason that you should do it immediately. Why wait for an arbitrary point in time? And some resolutions are just unachievable – such as my wish to stop making forecast errors!

The turn of the year is also an arbitrary point for judging economists, but this can influence behaviour. Is it better for your career to be correct frequently and then very wrong occasionally? Economies tend to grow over time and while past performance is not a guide to the future, history shows that global equity markets have tended to rise. It is therefore risky to try to time occasional recessions and associated sudden changes in market direction.

Anyway, I deflect from my current predicament, which is the lack of US recession that I have been forecasting for the last six to nine months (and counting) combined with a market increasingly telling me I am wrong. I see three unappealing choices:

- Admit forecasting is too difficult and too random. I think events are more random than economists make out. We try to talk in probabilities to capture the range of outcomes, but even here we confuse risk with uncertainty. We can pretend our discipline is scientific with econometrics but many of the inferences are meaningless when future distributions are different from the past. Still, l don’t want to talk myself out of a job as if the future is entirely random, what is the point of economists?

- Blame something else and capitulate to consensus. Everyone likes a good narrative and with the benefit of hindsight I can explain what I got wrong. Of course, forecast errors are always unexpected (in this case the surprising support to US growth from fiscal policy) while forecast success is pure skill! Perhaps I can present the outlook in a more entertaining way than the average economist, but if I settle with the consensus view it means most of what I now say is already in the price.

- Double down on the recession call. The problem here is that the more time elapses without recession, the greater the loss of credibility. By the time I am right (I am confident there will still be recessions at some stage in the future) everyone might have stopped listening.

So what to do?

I am reluctant to become more optimistic just because yields have fallen and risk assets have rallied. Inputting easier financial conditions in our models will raise my GDP forecasts, but it is totally useless for investment management unless you like momentum strategies and hope that when the turn comes it will happen slowly enough to get out in time.

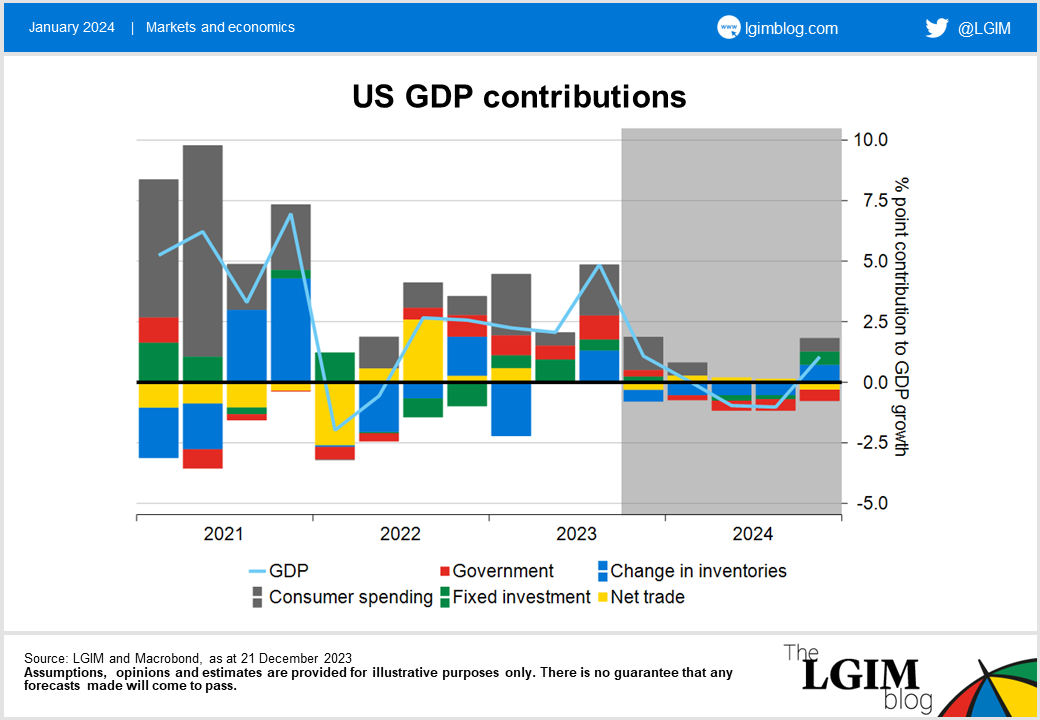

Yet there are feedback loops that have an impact here and I did revise up the central forecast accordingly just before Christmas (see chart below for US GDP). Nothing quite like sneaking out a forecast change when nobody is around! I am still just about clinging to the recession view, but it has been further delayed and I now see only a slight contraction in GDP from peak to trough of 0.5% versus a previous forecast of a 1.5% decline.

If I must have a new year resolution it would be to not take forecasting too seriously. Instead, the role is to weigh up the risks. It seems like the pendulum has now swung too far and there is too much confidence in a benign confluence of events.

Can economic growth be sufficiently robust to generate strong corporate earnings and at the same time can central banks be confident that inflation is sustainably back to target, allowing them to deliver the multiple rate cuts expected?

While I have to acknowledge that consensus could be right, I don’t think it will take many random events to knock the US and world economy off this course.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.