Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

What to factor in and what to factor out

Factor-based investing has seen rapid growth since the financial crisis, as investors look beyond traditional asset class labels to understand what really drives the performance of their portfolios. Bombarded with new products and an ever-growing body of research, what should investors focus on before jumping on the factor bandwagon?

Investors are using factor-based investing across equity, fixed income and multi-asset strategies, seeking a cost-effective route to enhanced returns, lower risk, or higher levels of income. But what exactly are factors?

Market factors can be defined as any broad driver of the performance of an asset class. Examples include growth, inflation and interest rate sensitivity. All three of these factors are typical drivers of corporate bond prices, for instance. Shocks to growth can hurt company profits and a bond’s safety, while changes in interest rates and inflation levels can affect the discount rate investors use to price the bond.

While broad asset class returns can be explained by the market factor (beta), drilling down to individual securities exposes a whole range of stock-specific characteristics that drive their relative performance. We can suddenly see that certain features, or factors, drive the performance of one security relative to another, and that these characteristics are distinct from broad market exposure.

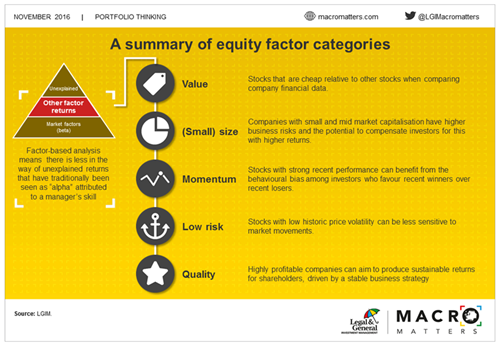

In the case of equities, these factors are usually labelled under broad categories such as:

- Value - measured by common valuation ratios

- Size - measured by market capitalisation

- Momentum - measured by recent performance

- Low risk - measured by historical volatility of returns

- Quality - measured by profitability and leverage

These groups of characteristics, alongside the market factor, help us to better explain different drivers of overall portfolio performance. Investors can now also invest in these factors more directly given the rise of a whole range of factor indices, which either targeting a single factor, or a few of them simultaneously via a multi-factor offering.

Importantly, while factors may drive risk and return, they do not necessarily produce a positive long-term return. Investors must therefore be careful to understand which factors are likely to be rewarded when choosing where to invest.

In making that important decision, we would suggest that investors factor out the historical performance which is often based on back-tested performance, and more at risk from over-fitting. Instead, they should consider the following three questions:

- Is there an economic reason, a behavioural trait or a structural anomaly as to why the factor should be rewarded?

- Is there a body of academic research supporting the existence of a positive return premium in the factor?

- Is there evidence of the factor working in multiple regions, time periods and possibly asset classes?

Answering these questions is fundamental before plotting a course towards factor-based investing if investors are to gain the type of outcome they desire; something we'll take a look at in my next post.

Adapted from The rise of factor-based investing, Diversified Thinking by Andrzej Pioch and Aniket Das.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.