Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Sticky bubble gum

The official motto of the Tokyo games is “united by emotion”. Investors seem to be following the Olympic example of unity, as the consensus outlook has been unchanged for months.

The narrative has been positive: there is a widespread belief that vaccines will beat the virus, that inflation will be transitory, that there will be long-term growth, that interest rates will remain lower for longer, and that central banks will not (or will not be able to) raise rates by enough to rock the markets. Naysayers have lost money.

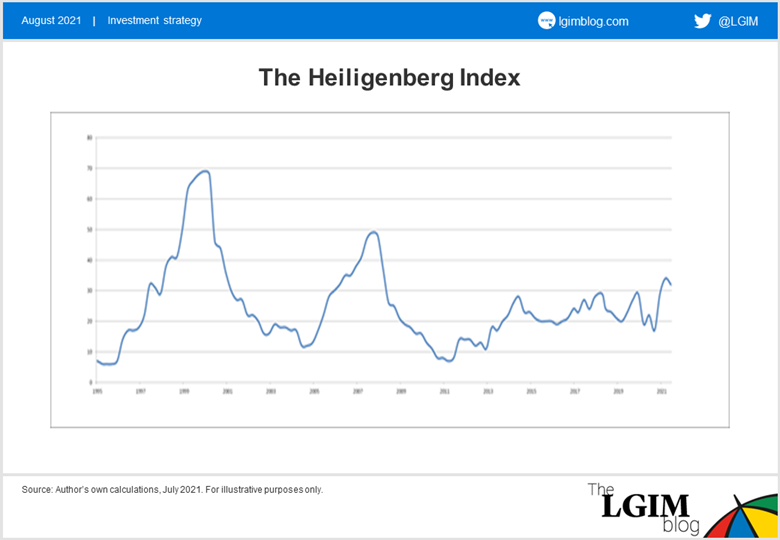

So with equity markets grinding higher, it’s an opportune moment to revisit our bubble index. Over my career I have constructed this index, which in all modesty I called “the Heiligenberg Index” to measure the risk of whether the market is in a bubble.

Perhaps surprisingly, not much has changed since last quarter.

The bubble index remains at its highest level since the 2008 financial crisis. This shouldn’t surprise anyone as the risk of bubbles is normally elevated when massive liquidity is pumped into the system by both monetary and fiscal authorities. The good news is that this bubble risk is not increasing, and in fact marginally decreased in the most recent quarter.

A few further considerations:

• There is little sign of broad financial deregulation, something that has been identified by an IMF paper as a warning sign of bubble formation. Banks are well capitalised and US Democrats might even strengthen banking rules when they get the chance.

• Interest rates have come down recently. Interest rates are a double-edged sword for bubbles: on the one hand, we see interest rates go up in the mature stage of a bubble; on the other, low yields can be a contributing factor to the formation of a bubble if they facilitate increasing leverage.

• Sentiment towards risky assets remains cautiously optimistic. In a true bubble, one would expect all caution to be thrown to the wind and pundits to talk at length about why this time is different. This is not happening yet.

• Finally, housing bubbles do often precede or coincide with market bubbles. Our head of economics is concerned today’s exceptionally low mortgage rates could lead to a significant overshoot of house prices and construction. This, together with an economic overheating later in 2022, might cause the bubble indicator to reach more worrying levels.

The fact that the Heiligenberg Index remains elevated but stable is one of the reasons we feel comfortable staying long equities. We are prepared to increase our exposure in a dip, as investors bask in the sunshine of a global economy in mid-cycle.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.