Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Happy birthday to our wellbeing hub!

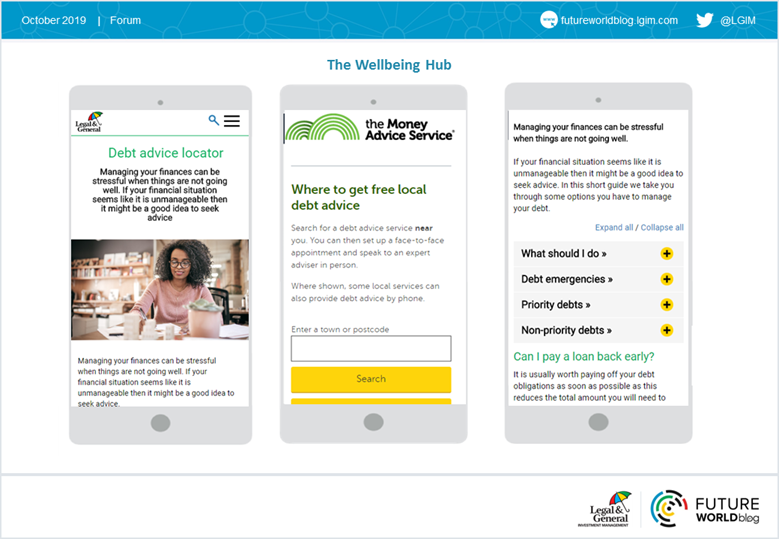

As our wellbeing hub turns one year old, we remain committed to being there for pension savers when they need us.

It’s been a year since we launched our financial wellbeing hub to give pension savers as much support as we can while they navigate life’s monetary ups and downs.

Our aim is to promote financial resilience at every stage of people’s working lives while encouraging them to plan for their retirement.

The hub is now available to 1.4 million pension-scheme members, and we’re delighted that in our first year we’ve been recognised in the 2019 Workplace Savings and Benefits awards as the Wellbeing Initiative of the Year.

The impact of money worries

Research regularly shows that financial stress has a huge impact on the work environment. Again and again, we see evidence of the scale of the issue and how it affects many of us in day-to-day life:

• 1 in 4 employees report that money worries have affected their ability to do their job (CIPD)

• 40% of people feel they do not have good control of their money or manage it well (Money Advice Service)

• 90% of employers agreed that financial concerns have an impact on workplace performance (Financial Advice Working Group)

• 69% of UK employers think they should take an active role in encouraging their employees to manage personal finances better (Willis Towers Watson)

Both employers and employees agree that if the latter knew where to go for help and guidance, they would have better control of their money. Further evidence suggests financial worries are a key cause of stress.

Supporting employers and their scheme members

Our hub was designed with the needs of ordinary pension savers in mind. We researched the range of help most people needed and found that common crunch points included:

• coping with debt

• managing on a budget

• buying a home

• saving for major events like weddings

• starting a family

Financial worries can be very distracting and can even compromise workplace performance. That’s why we believe in supporting employees and employers through our financial wellbeing hub.

We’re continuing to evolve our wellbeing services so we can keep being here for pension savers when they need us – at whatever stage they are in their lives.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.