Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Gold or broad commodity exposure: which is the better diversifier?

We've run the numbers to see how the two compare in terms of inflation hedging and offsetting drawdowns in multi-asset portfolios.

It’s easy to see why gold has a special place in the hearts of many investors. Ideologically separate from the whims of policymakers and the random walk of stock markets, the metal has been used as a store of value since Egyptian times. We believe gold can have a role to play in diversified portfolios, but it’s instructive to examine the rationale for investing in gold, and to examine the historical performance data.

Perhaps the most familiar argument for allocations to gold is inflation hedging. This makes intuitive sense: gold’s price constantly adjusts, but the physical metal itself is reassuringly unchanged by falls in the euro, dollar or pound.

However, broad commodities – representing the key physical inputs of the global economy – are another, more direct, way that investors might consider hedging the risks posed by inflation.

The below shows the correlation between gold and inflation expectations, and broad commodities and inflation expectations, with 1 representing perfect correlation and -1 representing perfect inverse correlation. Over the past decade broad commodities have consistently exhibited a higher positive correlation to inflation expectations, indicating they have more consistently reacted to periods of rising inflation with positive performance.

Bond correlation

Diversified portfolios generally include a mixture of equity and bond exposure, with the aim of dampening volatility.

However, as we saw in 2022, rapid rises in inflation can lead to increased correlation between equities and bonds. Higher input costs weigh on company margins, hitting equity markets, while interest rate rises enacted by central banks lead to bond market declines in total return terms.

So, what asset class can support a portfolio when both equities and bonds come under pressure?

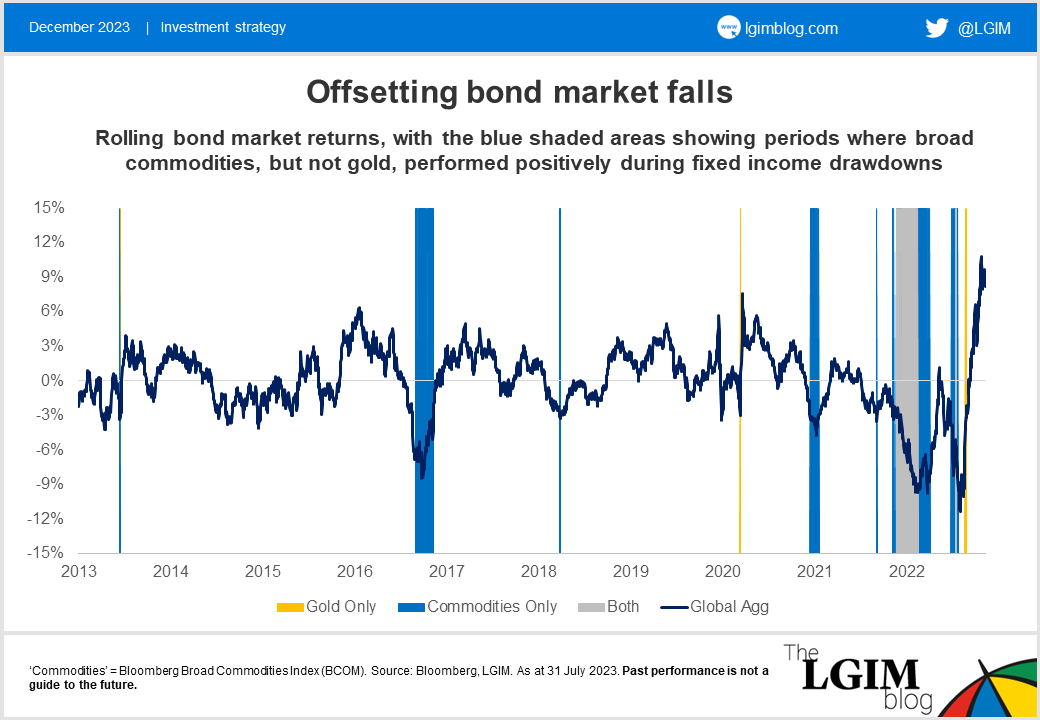

Offsetting periods of negative performance from bond markets is another key reason investors might look towards gold or broad commodities. Taking the same decade-long review period we considered previously, broad commodities outshone gold by more consistently generating positive returns during periods of negative returns for bonds:

Participation in rising rates

Another consideration for investors weighing up the potential pros and cons of gold and broad commodities is the income that can be earned through each asset class.

One of gold’s fundamental characteristics is that it produces no yield – its value is only realised when it’s sold.

Funds that capture broad commodity exposure, meanwhile, are often structured on a total return (TR) basis, meaning investors receive regular income payments tied to government bond yields. In this sense, broad commodities funds can be thought of as a ‘cash plus’ investment.

Although a synthetic gold strategy could be constructed that would allow investors to incorporate government bond yields in the same way as commodity funds, in practice this isn’t something that’s seen in the market. The reason is that gold is almost always in contango, meaning the negative roll yield has historically outweighed the benefits.

We covered contango and backwardation in a recent blog, and also explored the underlying structural reasons why gold can be expected to be in contango.

As the below shows, incorporating government bond yields into a strategy wasn’t significant in the era of zero interest rates that followed the global financial crisis in 2008, but rising interest rates have created additional returns for many broad commodity funds.

With US cash rates well above 5% currently, we believe this is not a source of return potential that investors will wish to forget!

While past performance is not a guide to the future, we believe history presents a compelling case for the role of commodities in hedging inflation, offsetting bond market falls and participating in periods of rising interest rates.

However, gold still has a role to play for many investors, in our view. Happily, there’s nothing stopping investors from allocating to both, capitalising on both gold’s permanence and broad commodities’ intrinsic link to the real economy.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.