Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Bubble trouble: is the stock market riding for a fall?

It's hard to tell when a bubble is about to burst, but the LGIM Bubble Index suggests we aren't at nosebleed highs yet.

The following is an extract from our Q2 Asset Allocation outlook.

Austria, March 2000. I’m skiing with one of my friends. After a few runs he signals to stop as he needs to make an urgent call. I can’t really follow the conversation, but I later understand he’s subscribed to the initial public offering (IPO) of internet service provider World Online.

“I didn’t realise you’re an investor too,” I say. “I wasn’t until now,” he replies, “this is going to be my first investment. I went all in – the internet IPO seems like a sure thing.”

I still regret that I didn’t recognise this conversation for what it was: one of the clearest sell signals I’ve been handed in my career.

To the moon

In my 30-year career as an investor, stock market bubbles have always been a fascination.

The combination of hope, greed and almost unstoppable herd behaviour drives a perfectly reasonable narrative – like the idea that artificial intelligence (AI) will impact large parts of society and increase productivity – into overdrive, with investors extrapolating exponential profit growth into eternity and sending valuations into the stratosphere.

After the bubble bursts, everyone understands asset prices were bonkers, but in the middle of the mania the attraction can be irresistible.

Are we in bubble territory?

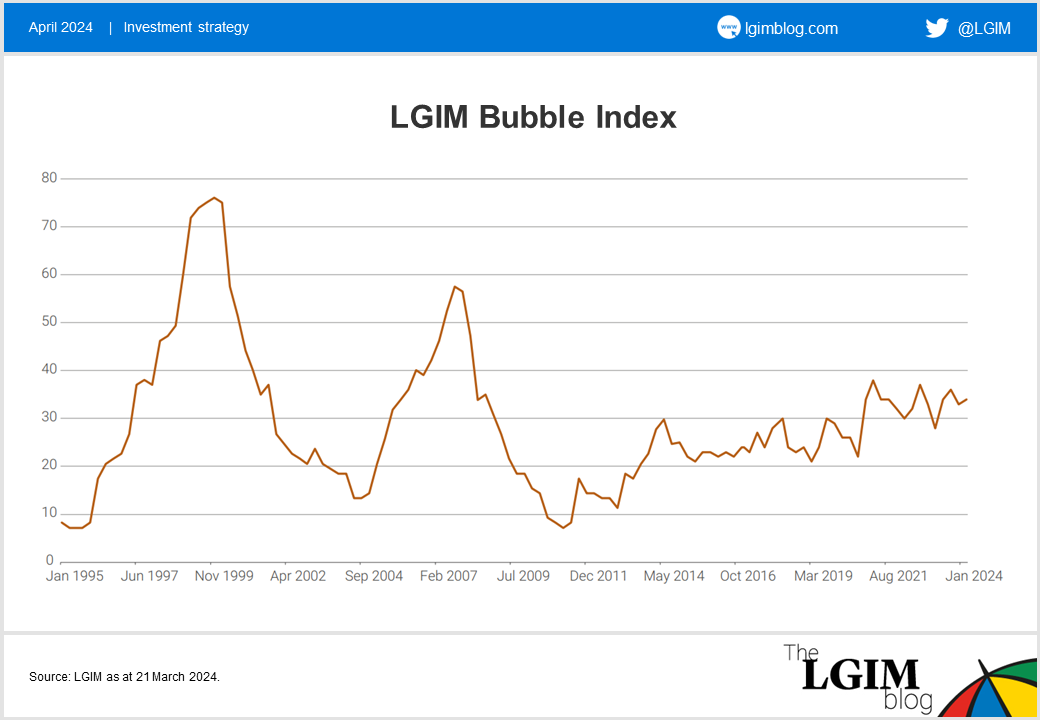

Over the years I have constructed a ‘bubble indicator’, which helps me judge whether markets are in danger of implosion. The bubble index contains 36 sub-indices in subcategories like excessive valuations, the macro environment, speculative trading and leverage, investor sentiment, and signs of herd behaviour.

The latest reading of the LGIM Bubble Index shows some frothiness and a very slow increase, but it’s still quite far from bubble-like levels.

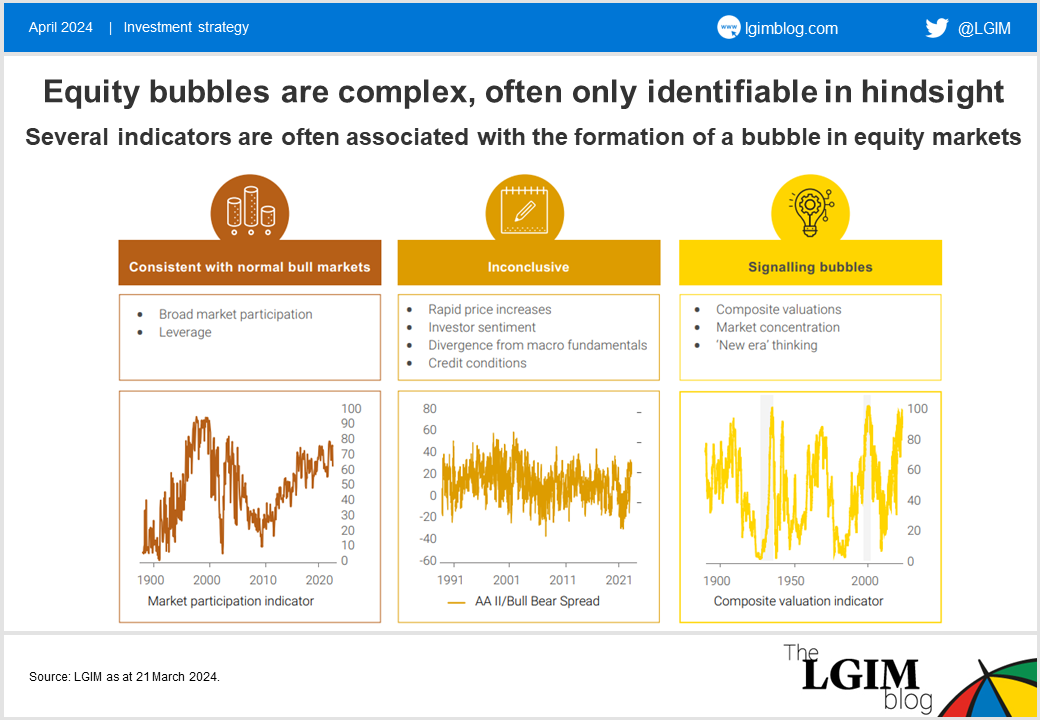

Some seeds of exuberance are present. We are late in the economic cycle and there is plenty of liquidity in the system. AI is an archetypical technological breakthrough in that it feeds the idea that “this time is different”. Pockets of the market have very rich valuations and market concentration in performance is rising.

However, there remain plenty of signals that we are potentially not yet at nosebleed highs:

- Overall leverage is not excessive

- Financial deregulation and financial engineering facilitating easy money and a rapid increase in leverage aren’t yet omnipresent

- M&A and IPO cycles remain relatively normal

The fact that the bubble has not yet occurred doesn’t make further increases in prices a given. Bubbles are difficult to anticipate, and full acknowledgement only happens after the burst.

There’s no doubt that US equities are rich relative to their own history, other equity markets and compared with bonds. We derive from this that returns over the medium term are likely to be below average, but this doesn’t tell you much about expected returns over the next three years.

But valuations are not, in our view, excessive like they were in the 1990s, and some frothy areas such as the SPAC boom have already deflated.

Are we nearly there yet?

The LGIM Bubble Index is at a level comparable with 1997 in the tech bubble or 2005 in the US housing market bubble, suggesting a bursting isn’t imminent.

AI could feed a narrative that grows into an exuberant mania. However, this is just one possible outcome. It’s by no means guaranteed, or even the most likely outcome. As such, other macro questions remain very relevant.

We continue to believe in diversifying our portfolios. Though we like equities with AI exposure, we don’t believe investors should go all in on the theme in anticipation of a bubble emerging.

Special thanks to Roger, a friend for life and a great predictor of stock markets, for helping to shape my thinking around market bubbles.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.