Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Applying growth equity investing to operational real estate

On the back of our recent report looking at investing in real estate operating companies, we assess how growth equity investing can be applied to operational real estate assets.

Defining operational real estate

Operational real estate is defined as an investment style where the return is directly and deliberately linked to the revenues and profits of the business conducted on, or from, the premises[1].

We believe exposure to this strategy can be a potentially attractive income style given it transfers a proportion of the profit margin and the upside that would otherwise go to the business operator to the asset owner. The owner does take on greater exposure to the business cycle – both its growth and volatility, but this is likely compensated by higher going-in yields.

Growth equity investing

Growth equity (GE) investing when applied to operational real estate involves focusing on the operational platforms themselves. It draws on a set of value creation levers, which we’ll list below:

Acquisition & Structuring: This strategy focuses on enterprises, often founder owned, which have a track record of operations and are ready to scale. One study on the UK reports that the median target company in a sample of GE investments between 2000-21 was eight years-old, EBITDA positive and had 74 employees.[2]

Organic growth and operational improvements: Once owned, investors accelerate revenue by scaling proven business models as well as making operational improvements. Those operational improvements often include governance steps, such as supplementing management. In the study mentioned above, investors took board seats 70% of the time, brought in additional (non-investor) directors 70% of the time and, occasionally (roughly 1 in 4 cases), changed the CEO.[3]

Bolt-on acquisitions: Inorganically, investors can pursue acquisitions to access new customer segments, technologies or geographies and aim to achieve synergy benefits. This is a more specialist activity; only 20% of GE-investee companies made an acquisition during the period of ownership. But those that did were active, with an average of 3.4 companies acquired.[4]

Exit: The typical exit route is via sale to a trade buyer, another financial investor and, in some cases, to management. Very occasionally, GE firms go straight to IPO. GE firms do also fail – this is a specialist space that requires expertise and track record. The mechanism for achieving a premium exit over and above trading performance at the point of exit is to create a pipeline of business expansion that an acquiror can underwrite and assign value to.

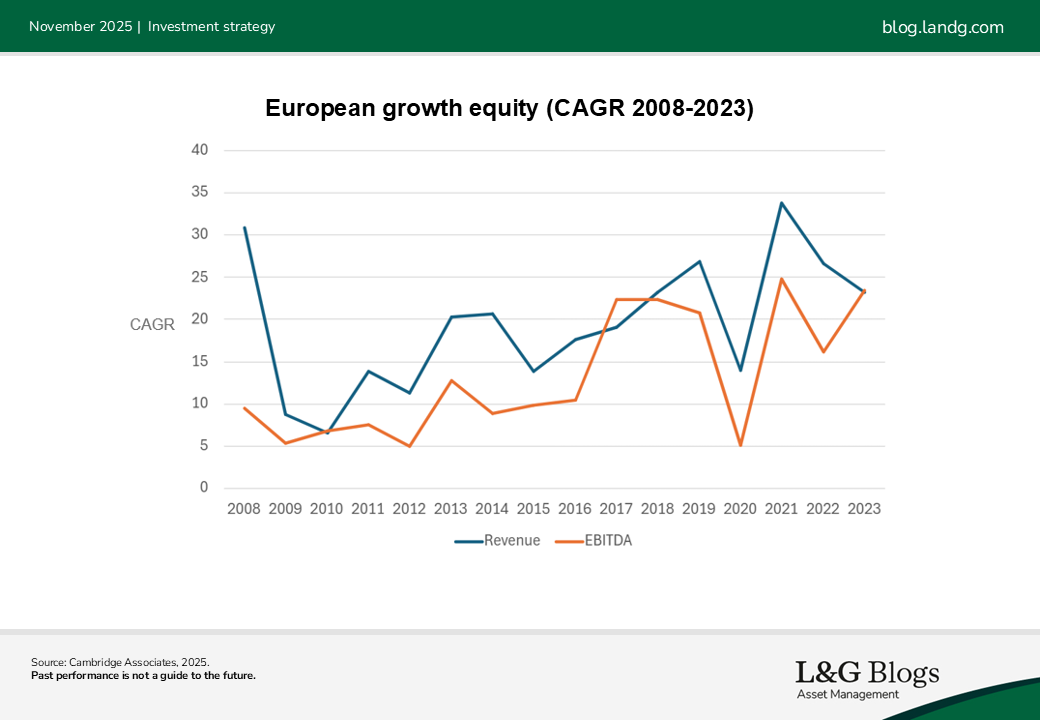

Cambridge Associates database of private company metrics illustrates the results. Its analysis of investments reported by GE managers showed compound annual average growth of 19% and 13% for revenues and EBITDA, respectively, between 2008-2023.[5] It was notable that both revenue and EBITDA growth weakened but remained positive during both the GFC and Covid-19 periods.

In our next blog, we’ll assess how growth equity investing can be compared to other real estate investing strategies seeking to generate outsized returns by embracing higher risk and active value creation.

Assumptions, opinions, and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts will come to pass. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested.

[1] Investment Property Forum (IPF), Operational Real Estate, Risk and Reward, 2021

[2] “Growth Equity Investment Patterns and Performance”, Lavery, Megginson, Munteanu, 2024

[3] “Growth Equity Investment Patterns and Performance”, Lavery, Megginson, Munteanu, 2024

[4] “Growth Equity Investment Patterns and Performance”, Lavery, Megginson, Munteanu, 2024

[5] “Private company operating metrics: global analysis”, Cambridge Associates, 2025

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.