Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

The future of private markets

The four megatrends shaping the portfolios of 2030 and beyond.

We believe that exposure to private markets can potentially add to total portfolio returns for multi-asset investors. Alongside the diversification[1] benefits investing in private assets can offer, this can also potentially reduce overall portfolio risk and boost risk-adjusted returns.

However, there are several observable megatrends that are in our view already reshaping private markets, creating both risks and opportunities.

To maximise the benefits of adding private market exposure, we believe it is vital to embrace structural change when allocating in different asset classes and sectors.

We have developed a long-term structural framework to guide our investment strategy around four powerful megatrends that we believe are reshaping the global economy:

- Demographics

- Decarbonisation

- Digitalisation

- Deglobalisation

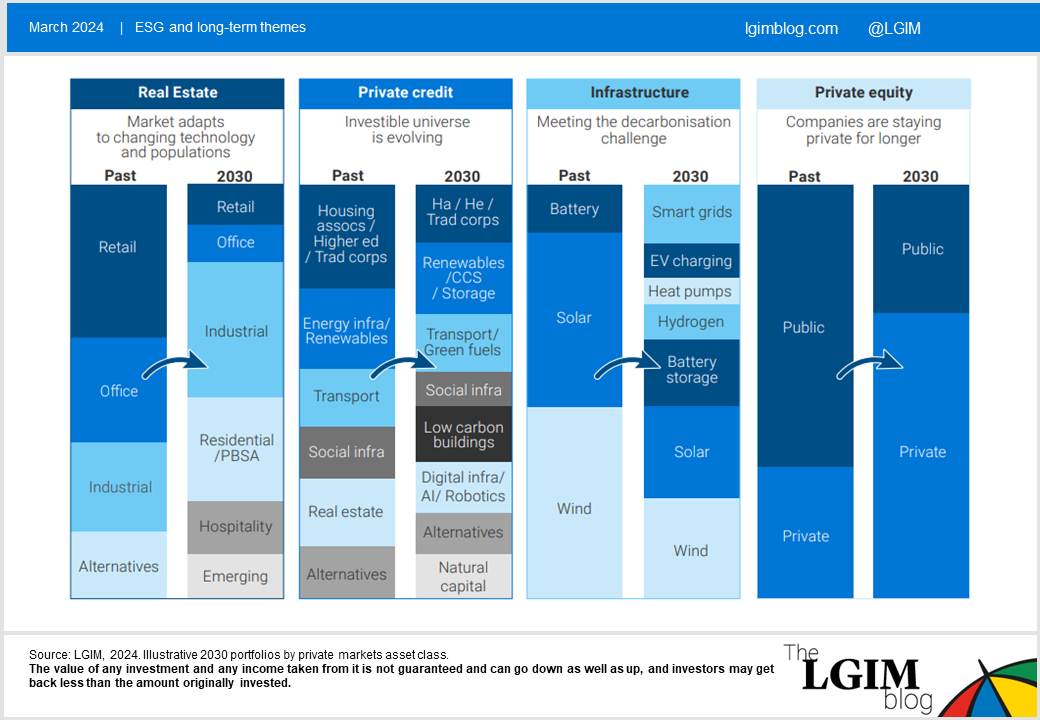

We have illustrated one possible scenario for how private market allocations could evolve in response below:

We believe that these trends will be positive for a number of sectors and challenging for others, and that portfolios that embrace them may see outsized risk-adjusted returns.

We see these megatrends as particularly beneficial for infrastructure supporting the energy transition, residential real estate, urban logistics, and assets/ companies associated with the digital economy.

We believe investors increasingly need to build expertise in areas that may at present appear niche, but could represent scalable investment opportunities over the longer term. In this light, we see great potential in sectors like desalination, green hydrogen, natural capital and senior living.

Click here to read our full paper on the future of private markets.

[1] It should be noted that diversification is no guarantee against a loss in a declining market.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.