Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

How we address responsible investment in Liability Driven Investment portfolios

Liability Driven Investment portfolios are generally made up of gilts, derivatives and cash. In this blog, we look at how responsible investment considerations can be integrated into these portfolios

The main objective of Liability Driven Investment (LDI) is to provide a hedge against pension scheme liabilities. We see responsible investing as the incorporation of financially material sustainability considerations into investment decisions, alongside engagement with companies, regulators, and policymakers, to help drive long-term value creation and support real-world outcomes for our clients. We believe that the integration of responsible investment considerations within LDI portfolios provides a real opportunity to add value for clients and to change the industry for the better.

The three main building blocks of LDI portfolios are gilts, liability-hedging derivatives and cash.

For each of these building blocks, there are two key avenues that we focus on as we aim to drive positive outcomes for our clients:

1. Engagement – to help ensure stakeholders are following practices aligned with our responsible investment approach

2. Asset allocation – to help ensure the securities we choose to invest in for our client are aligned with our responsible investment approach

Gilts

Gilts are typically the largest physical asset in LDI portfolios and, globally, defined benefit pension schemes are among the largest holders of gilts. Let’s look at how we address this asset class from the two avenues listed above.

1. Engagement

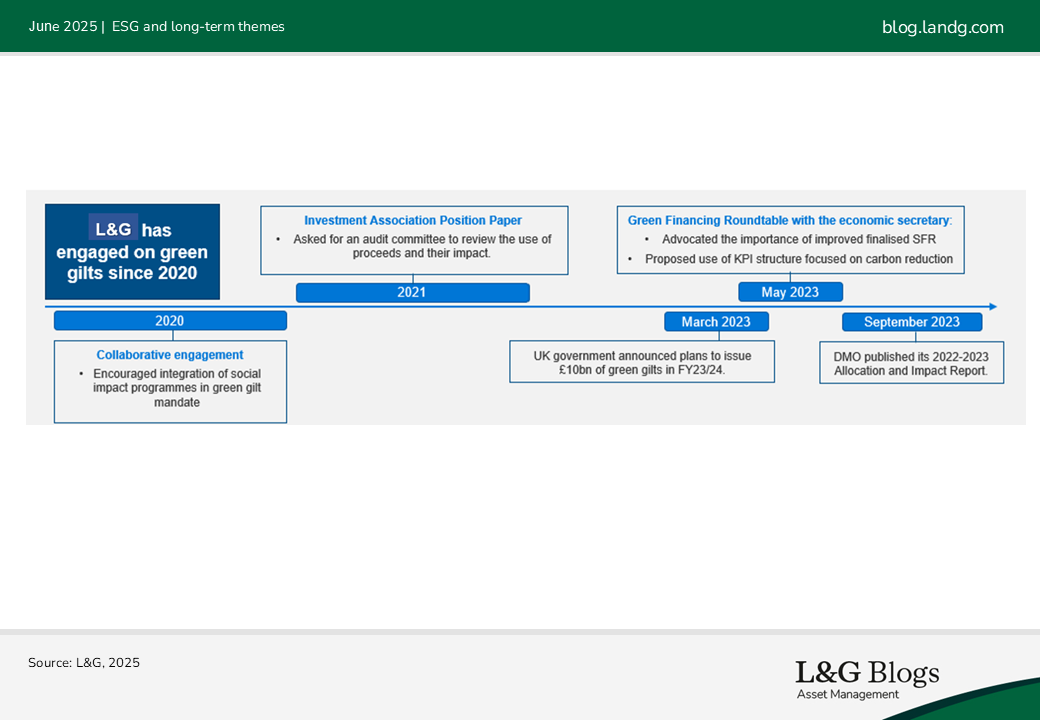

Given the scale of gilt holdings in a typical LDI portfolio, engagement with the UK Government, regulators and other related market participants should, in our view, be of significant focus for LDI asset managers. Below we detail our engagement with various stakeholders on the issuance of green gilts.

2. Asset allocation

Green gilts are issued by the UK Government specifically to fund environmentally friendly projects. The funds they raise are earmarked for initiatives that help tackle climate change and promote sustainability – for example, zero-emissions buses, offshore wind farms etc. Given this, green gilts may be able to provide opportunities for effective responsible investment within an LDI portfolio. From an investment perspective, we look to treat green gilts in the same way as their conventional ‘vanilla’ counterparts, though clients have the ability to include additional mandate objectives for us to prioritise the purchase of green gilts.

Since 2020, we have worked closely with the UK Debt Management Office (DMO) on the topic of green gilts, successfully advocating for long-dated green gilts which we can incorporate in LDI portfolios.

Derivatives

Typical derivatives in an LDI portfolio include interest-rate swaps, inflation swaps and gilt repurchase agreements. These exposures are provided by counterparty banks who accept collateral in return for providing a specific exposure, for a specified amount of time. Let’s look at how we address this asset class.

1. Engagement

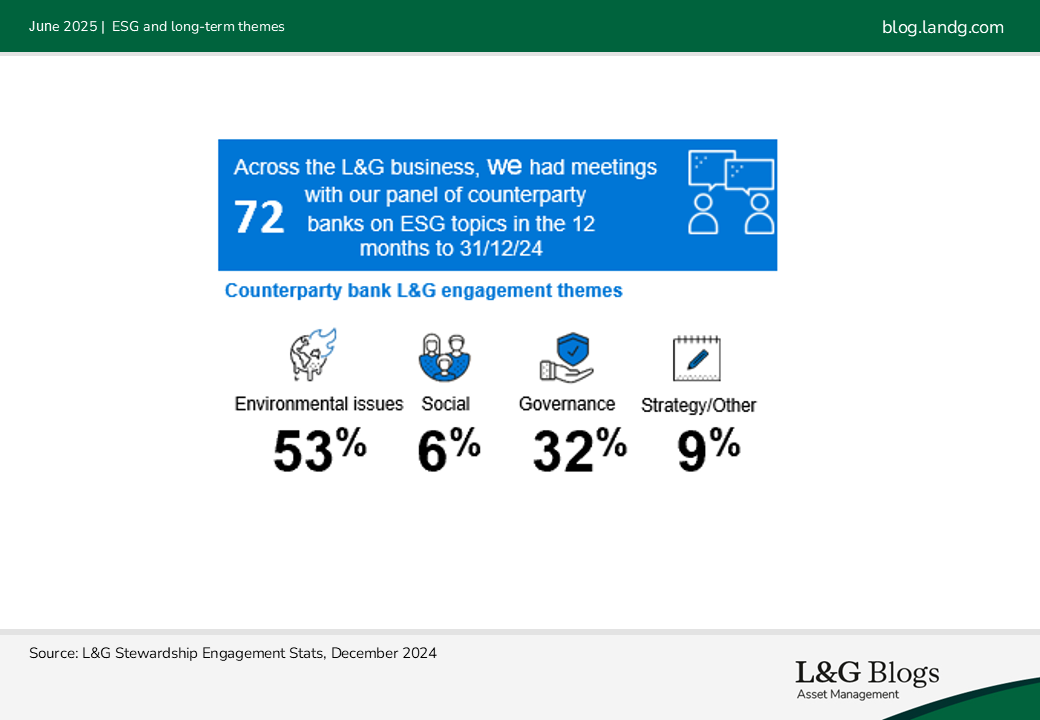

There is significant scope for engagement with derivative counterparty banks on all responsible investment issues. The scale of our ongoing business means that we have a strong platform to leverage our relationships and incorporate topics that matter to our LDI clients in our engagement with counterparty banks.

2. Asset allocation

Responsible investment can be effectively embedded into the derivative counterparty review process, alongside other business and financial risks. Counterparties should be monitored on an ongoing basis and removed from the panel if there are significant responsible investment concerns, in conjunction with financial concerns.

Cash

Often, in addition to physical cash holdings, LDI portfolios also hold liquidity funds which aim to provide investors with principal stability, liquidity, and yield. Liquidity funds often hold the short-term bonds of corporates, and this provides an opportunity to consider stewardship via the asset allocation decision-making and engagement with corporate bond issuers.

1. Engagement

Targeted engagement with corporates – with consequences – is essential. More on our approach to active ownership can be found here.

2. Asset allocation

In general, we believe in prioritizing engagement over exclusions and divestment. Nevertheless, it can be important to include some exclusions to reflect globally accepted standards of business practice. Divestments can incentivise companies that are lagging in climate action to accelerate their transition and enhance the long-term sustainability of their businesses. We incorporate these features in our liquidity funds via our Climate Impact Pledge and Future World Protection List, more information can be found here and here.

Whilst L&G has integrated Environmental, Social, and Governance (ESG) considerations into its investment decision-making and stewardship practices, this does not guarantee the achievement of responsible investing goals within portfolios that do not include specific ESG goals within their objectives.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.