Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Coal: It’s better to phase out than to burn away

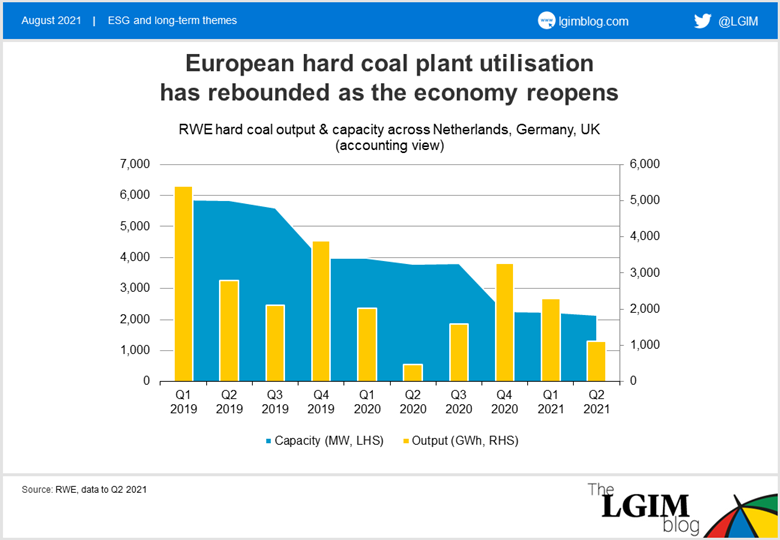

The European Commission’s recent communication on the 2030 climate target, “Fit for 55”, has shone a spotlight on the bloc’s efforts to remove coal from its power generation mix. The region made substantial progress in reducing coal-burning in power plants during 2019, helped by its main policy lever, the EU Emissions Trading Scheme (ETS), although there are some signs of a resurgence in coal burning versus an anomalous 2020.

The “Fit for 55” plan proposes strengthening the ETS carbon scheme further, which should tilt the economics yet more towards closing coal plants within the bloc. Indeed, we believe that OECD countries should not run thermal coal beyond 2030 if the world is to stay on a 1.5C path.

However, closing generation capacity can be politically and socially complex in coal-mining regions. Supplying local power plants with coal can be a major source of employment and contributor to economic activity. Shuttering generation capacity might also reduce local energy security, if alternatives can’t be installed quickly. This is a complex, political issue.

Utility function

Utility companies are well-placed to mobilise the investment in power infrastructure needed to accelerate the transition to a lower-carbon economy. But owning legacy coal operations might constrain how efficiently they can access the capital required. Carefully audited “Use of Proceeds” financing (for example, green bonds) could help, but many investors might prefer simple blanket exclusions on companies with material coal exposure.

What can utility companies in this situation do? Simply closing capacity might be illegal or incur unacceptable political risk through reprisals against other parts of the business. And selling to a financial buyer, such as private equity, to run the assets down would probably not be environmentally responsible and, again, might be politically risky.

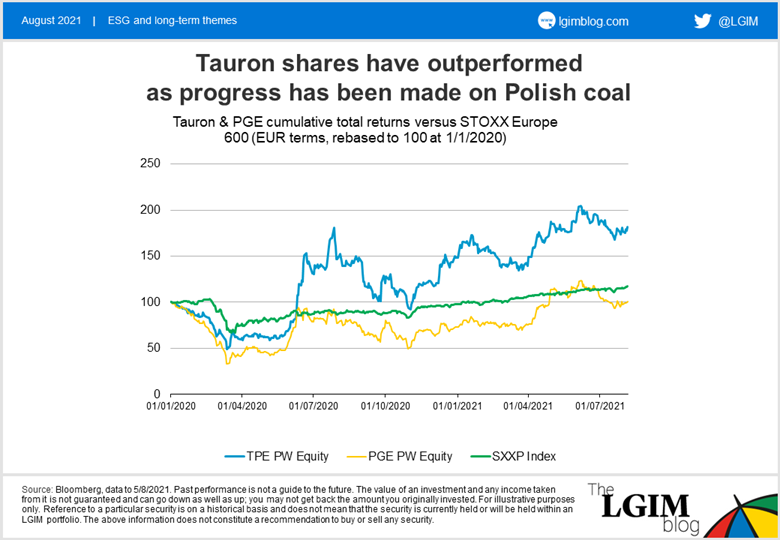

In Poland, the state – recognising the political nature of the problem – is taking a key role in its resolution. Some progress was made last year on negotiating an exit from coal by 2049 with the unions. And earlier this year, the state published a plan to acquire coal power generation units, as well as lignite mines, from local utilities PGE, Enea and Tauron.* Valuations are yet to be determined, and hard coal mines are to be handled in a separate process. But this marks an important step towards freeing these companies up to invest in the transition, and making them more investable. Progress on the issue of coal has coincided with a re-rating of Tauron’s share price in particular.

Turning to Germany, we think a similar solution to Poland’s could work in principle. However, with the Green party running second in the polls ahead of elections in September, there is a debate over reopening the 2038 coal phase-out contract and accelerating it to 2030. This makes separating coal operations from the wider business difficult today, because key valuation parameters could move. We expect progress following the elections.

So, what should investors do? We believe investors should support utility companies in seeking to dispose of difficult-to-close coal operations, but only where the disposal is to socially responsible, well-capitalised buyers, supported and closely supervised by the state. In our engagement with RWE’s senior management, for example, we have called for the company to investigate such a transfer.

We think transfers like this could make the remaining transition-focused companies more investable for many of our funds and for the market more generally. And for investors without coal exclusion constraints, there may be an opportunity to invest early, if there is conviction that a transfer will happen.

*For illustrative purposes only. Reference to a particular security is on a historical basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security.

Appendix: performance of securities and indices cited

Total returns in EUR terms

| Column 1 | TPE PW Equity | PGE PW Equity | SXXP Index |

| % | % | % | |

| 30.06.2016-30.06.2017 | 30.25 | 8.4 | 19.04 |

| 30.06.2017-30.06.2018 | -38.19 | -25.47 | 3.68 |

| 30.06.2018-30.06.2019 | -22.83 | 5.89 | 5.19 |

| 30.06.2019-30.06.2020 | 31.67 | -31.58 | -3.75 |

| 30.06.2020-30.06.2021 | 38.94 | 34.62 | 29.3 |

Source: Bloomberg, data to 30 June 2021

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.