Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

Charged for growth

In the first of a two-part blog series, we look at the growth potential of the EV charging sector and consider the implications for investors.

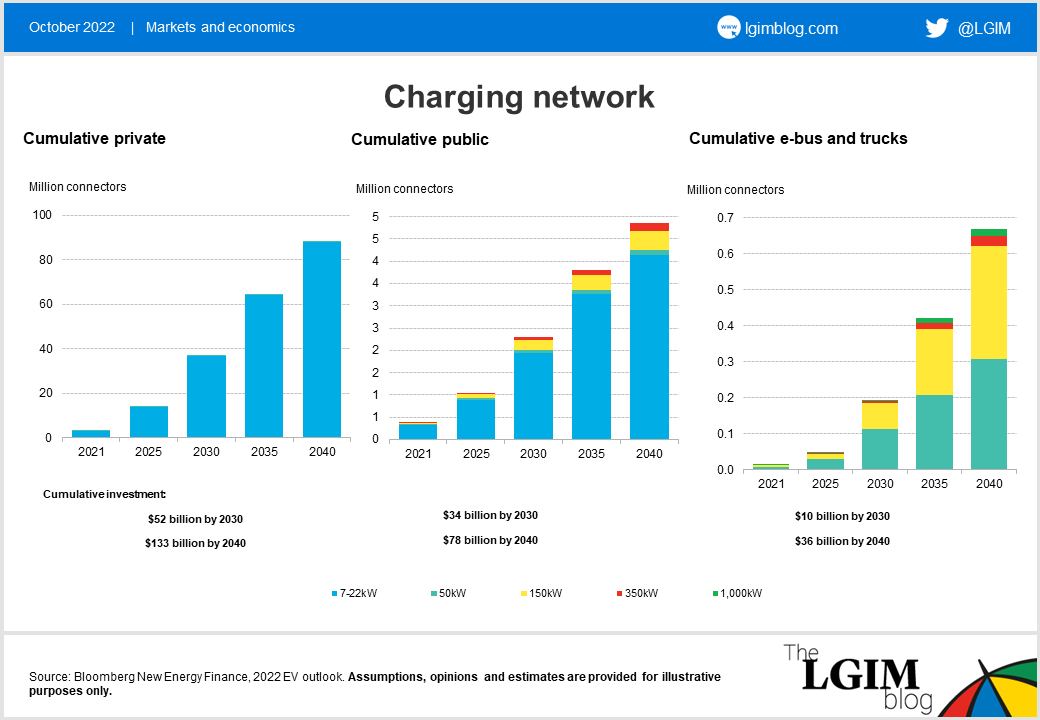

The electric vehicle (EV) charging market has been growing rapidly over the last few years, off the back of the increase in EV adoption, primarily in China and Europe. In its latest annual EV outlook, Bloomberg New Energy Finance forecasts that by 2040, EVs will make up nearly 90% of new passenger vehicle sales in China and Europe and 80% in the US. Although the US has been late to the party, the recent Inflation Reduction Act seeks to kickstart the EV revolution in America.

This will drive up demand for charging services, especially public chargers for longer journeys, commercial/public transport vehicles and an increasing number of EV owners who do not have access to home charging.

The competition is accelerating

EV charging companies operate across different parts of the value chain and have increasingly diversified their service offerings. Some focus more on the provision of hardware, monitoring and maintenance services. Others prefer to own EV charging infrastructure and monetise the electricity sold to drivers.

That said, the market has become increasingly competitive, with more players entering the market. Oil and gas producers, utility companies, and car manufacturers are also ramping up their investment in this sector as part of their pivot to renewables, either via acquisition or developing their own footprint.

While EV charging companies relied heavily on venture capital for funding in their early years, the sector is becoming more institutionalised in the UK. In the third quarter of 2022, Connected Kerb* and Gridserve*, both EV infrastructure providers, received substantial equity investments from Aviva* and M&G*, and we expect the trend to continue as infrastructure managers seek new areas of growth.

Power hurdle

For EV charging companies which own and operate chargers, the key to commercial success is high utilisation. EV charging companies have been engaged in a fierce land grab to install chargers at sites with high, predictable customer traffic, for example in retail parks and along major roads.

Aside from location, the availability of power is another key hurdle. Building a hub of fast and super-fast chargers (direct current, speed of 50+kW/h) often requires an upgrade of local grid capacity, which can take several months of advance planning, with the cost running into hundreds of thousands, or even millions of pounds in the UK. We are also seeing a trend of EV charging operators providing onsite renewable energy generation and battery storage to ease reliance on the grid.

Investment implications

The sector continues to be loss-making so demand for capital will remain high to generate the growth required to keep up with EV penetration. Analysts are predicting the mid-2020s as the point when leading operators might reach profitability. This is highly dependent on the overall EV take-up rate, which has seen a strong uptick in recent years but may slow down in the face of weaker consumer spending.

We anticipate institutional capital to increase its footprint significantly over the coming years as the sector matures, with equity investors taking the lead. From a debt perspective, scale and a profitable track record should pave the way to an investable credit rating in the medium term and help attract financing at lower costs from a wider investor base, which, we believe, will expand debt capital deployment and support sustainable growth.

In part two, we look at the economics of EV battery recycling and consider the potential risks and opportunities for investors.

*For illustrative purposes only. Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security.

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.