Disclaimer: Views in this blog do not promote, and are not directly connected to any L&G product or service. Views are from a range of L&G investment professionals, may be specific to an author’s particular investment region or desk, and do not necessarily reflect the views of L&G. For investment professionals only.

A cautionary “green” tale…

There is little doubt that capital markets have a considerable role to play in creating a more sustainable future. Bridging the funding gap to achieve global alignment with the Paris Agreement and the broader set of targets contained in the Sustainable Development Goals (SDGs) means that mobilisation of private capital will be an essential factor, alongside a mix of policy and regulatory measures.

However, capital markets face challenges in delivering these objectives: they often fail to reward the positive environmental and social performance of companies, and often put insufficient emphasis on long-term external costs resulting from corporate failures.

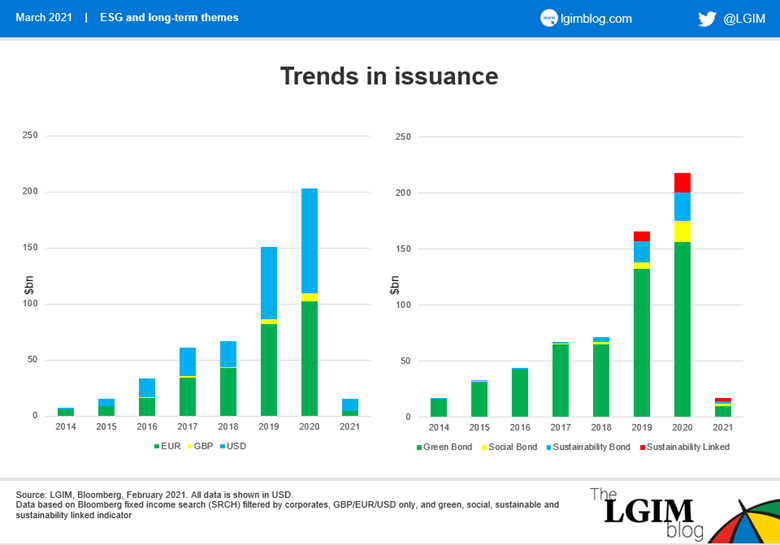

Going green: trends in issuance

Use-of-proceeds bonds (i.e. green/social/sustainability bonds) and more recently Sustainability Linked Bonds (SLBs) – together referred to as ‘sustainable’ debt – have been heralded as an innovative response to these issues. They seek to move debt markets towards projects or assets that can help achieve positive social and environmental outcomes.

The market has now gained traction: by the end of 2020, the value of total sustainable debt outstanding had passed the $1 trillion mark.[1] This is no longer a market dominated by sovereign and sub-sovereign issuers: in 2020, corporate debt represented approximately 30% of total issuance.

The breadth of issuers has also increased significantly. The issuance of this debt was once predominantly the remit of banks and utilities. Since 2014, our data suggest that these two sectors have represented approximately 70% of corporate sustainable bond issuance. However, this year is illustrating how this trend is changing, with the proportion closer to 50% by the end of January 2021.

Proceed with caution…

This unabating trend has offered a moment of reflection to remind ourselves of the purpose of capital markets – which is, ultimately, to facilitate the efficient allocation of capital. Excess levels of demand over supply have created problems in the past when the system’s response to this imbalance has been to create new debt instruments to allow money to flow into markets.

This is intended to satisfy investors’ exposure requirements at the time, to lower the cost of funding for borrowers, and provide fee income for the facilitators. Everyone’s a winner, right?

Unfortunately, we have witnessed this conflict of interest time and time again throughout financial history. It rarely ends well. The tech IPOs that came thick and fast in the late 1990s fuelled the ‘dotcom bubble’, and we saw another variation on the same theme in the global financial crisis, with the creation of RMBS, CLOs and CDOs[2] – most, if not all readers, will remember how that ended.

If structured properly, green bonds – or debt issuance related to ESG factors – should tick a lot of boxes for investors, given the significant momentum behind this industry trend. Their current popularity can be seen in the premium (or “greenium”) these bonds are being issued at, compared with a company’s existing debt. However, if linked to the wrong projects or targets, these ‘green bonds’ risk becoming at best an irrelevance or at worst a smoke screen attempting to mask a company’s true ESG credentials.

This capital-access channel is simply too important to suffer a similar fate. We are all acutely aware of the enormous responsibility “business” has to play in the transition to a more sustainable, low-carbon economy.

At LGIM we have taken this responsibility seriously for over two decades and our stance remains firm; part of our role is to aim to use our influence to ensure sustainable bond proceeds (whether green or social) are appropriately deployed by the issuing company.

More importantly, in sustainability-linked bonds, the terms and conditions of what companies sign up to should not be left to the issuing companies and their bankers. It is imperative that those investors putting their capital at risk have a strong say in what constitutes a genuine improvement in the sustainability profile of a company.

How we analyse sustainable bonds at LGIM

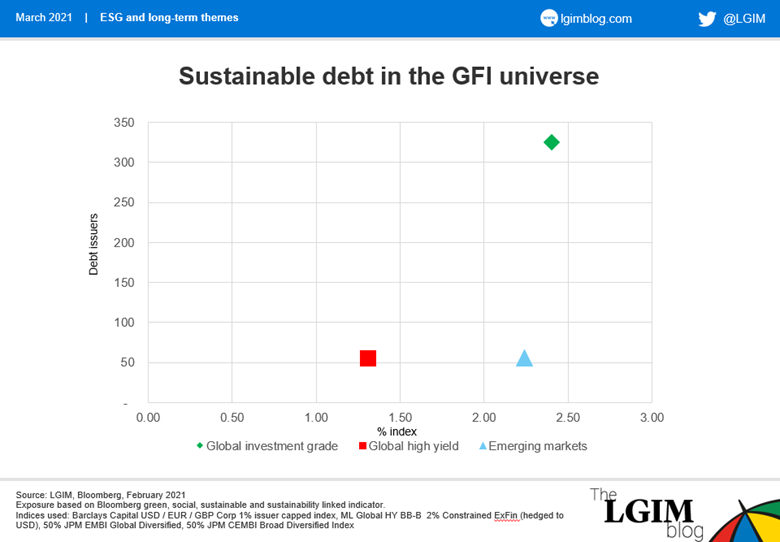

Irrespective of the bond label, ESG criteria are integrated into all our investment decisions for our active credit strategies; we consider a company’s ESG risks and opportunities alongside all other fundamental credit drivers. It’s important to remember that for an issuer, the interest and principal of the sustainable and of the vanilla bond are paid for by cashflows generated from the same balance sheet. Understanding the overall risk at the issuer level is therefore essential.

As a result, we do not see sustainable bonds as a more appropriate investment than a vanilla bond issued by the same company. Similarly, we do not see portfolios which include sustainable bonds as having a superior ESG profile to those that do not.

The biggest success of the sustainable bond market has been the increased transparency, disclosure and dialogue on ESG topics. We think that in the long run, broader efforts within the ESG market to standardise disclosure and build consensus on a sustainable taxonomy of activities for each sector will create less reliance on bond labels overall.

[1] Please note, the figure of $1 trillion relates to the entire market labelled as “debt”, whereas the figures in the charts above refer to our investable universe within the stated parameters.

[2] Initial Public Offering, Residential Mortgage-Backed Securities, Collateralised Loan Obligations, Collateralised Debt Obligations

Recommended content for you

Learn more about our business

We are one of the world's largest asset managers, with capabilities across asset classes to meet our clients' objectives and a longstanding commitment to responsible investing.